Dispute Credit Collection Letter

The majority of the links on our website are affiliate links. This means that if you click on the link and make a purchase, we earn a small commission at no additional cost to you.

Dispute Credit Collection Letter aka Debt Validation Letter

The Impact of Collection Dates on Your Credit Score

When dealing with collections, the impact of a collection doesn’t depend on the amount owed but rather on the date of the first missed payment. The credit system places greater emphasis on recent activity, meaning older collections have less effect on your credit score.

Legally, debts can remain on your credit report for seven years from the first missed payment, and debt collectors cannot force repayment after this period. However, they can legally keep pursuing the debt.

It is illegal for them to keep reporting it to the credit bureaus. It is essentially up to you if you want to pay the debt back after the statute of limitations. Keep in mind that if you acknowledge the debt as yours by paying any -amount to the debt, the statute of limitation starts over. And the debt becomes recent activity and will be considered a late payment until it is paid off.

What is a Charge-Off?

A charge-off happens when an account goes unpaid for six months, prompting the creditor to close it and write it off as a loss. This does not eliminate your obligation to repay the debt. The creditor cannot accept money towards the debt once they charge it off. The balance should show $0. A charge-off can stay on your credit report for seven years from the first missed payment and negatively impacts your credit score until it’s resolved. Charge-offs have a more significant negative impact than a late payment.

What is a Collection?

A collection happens when an account is severely past due and defaults, leading it to be sold to a collection agency. When this happens, you may see two negative entries on your credit report: one from the original creditor and one from the collection agency, both representing the same debt.

Statute of Limitations on Debt

The statute of limitations determines how long a creditor can legally sue you for repayment, typically lasting seven years from the first missed payment. If the statute of limitations is nearing expiration (two years or less), it’s often best to leave the debt alone and let it fall off your credit report naturally. However, if the account is more recent (2-4 years old), paying it off in full can be beneficial, Remember, that the law does not allow for the negative item to post more than seven years. It does not mention that it must remain for 7 years.

Handling Collections: Key Considerations

- Balance Owed: Smaller balances, such as $500, may be worth paying off in full to avoid the ongoing negative impact.

- Ownership of the Debt: Has the account been sold to a collection company or does the original creditor still own the debt, but their collection department is pursuing the debt. If the account has been sold, then the original creditor does not own the account anymore and cannot collect on it. Therefore, the balance under the creditor should show $0. This mistake is very common, in this instance, the report is reporting false information and has to be deleted. You can send a letter to the credit bureaus that show the incorrect balance demanding the account be deleted. But you must be careful in your letter to not acknowledge the debt. If you state that you already paid off that debt, the credit bureau(s) will correct the balance to show$0. You do not need to give them any explanation. You just say that the account is showing false information and has to be deleted.

- Factual Errors and Inaccuracies: If there is anything out of place, wrong date, a typo, anything wrong. You can demand the account to be deleted because the information is false. The furnisher’s reporting must be consistent with the bureaus. If it is inconsistent then it is misleading. And you have the right to demand deletion. If you compare your three reports side by side. Finding inconsistencies is much easier. If there is, all you need to do is to send a short, simple letter to the credit bureau(s) that states, “This account is reporting factual errors. DELETE.”

Deleting Charge Offs and Collections

Misconceptions About Charge-Offs and Collections

Charge-offs and Payment Responsibility

Q: “Does a charge-off mean I’m no longer responsible for the debt?

“A: No, this is a common misunderstanding. Think of it this way: if a store writes off stolen merchandise as a loss, it doesn’t mean the thief can keep it without consequences. Similarly, when a creditor charges off your account, you’re still obligated to pay. The charge-off will continue to negatively impact your credit score until you resolve the debt.

Third-party Collections and Debt Validity

Q: “If my unpaid debt is sold to a collection agency I never agreed to work with, am I still responsible for payment?”

A: No, this isn’t entirely accurate. It’s standard practice for creditors to sell unpaid debts to collection agencies, and it’s perfectly legal. Your responsibility for the debt remains, even though it’s now with a different company. However, the collection agency must comply with the Fair Debt Collection Practices Act (FDCPA) in their collection efforts. You have the right to ensure their compliance before making any payments.

Debt Settlement and Credit Score Impact

Q: “Will negotiating a settlement for less than the full amount owed on a collection or charge-off harm my credit score?”

A: No, settling a debt for less than the original amount won’t lower your credit score. In fact, resolving the debt through a settlement can actually improve your credit situation.

A Preliminary Step That May Work for You

If you do not live at the same address that is listed on the collection account, before you do anything else, remove the old address from your credit report. This prevents the credit bureau from linking the collection to you via the old address, which can help dispute the collection.

Download Sample Letter for removing old Addresses

Strategy for Removing a Collection with a Balance

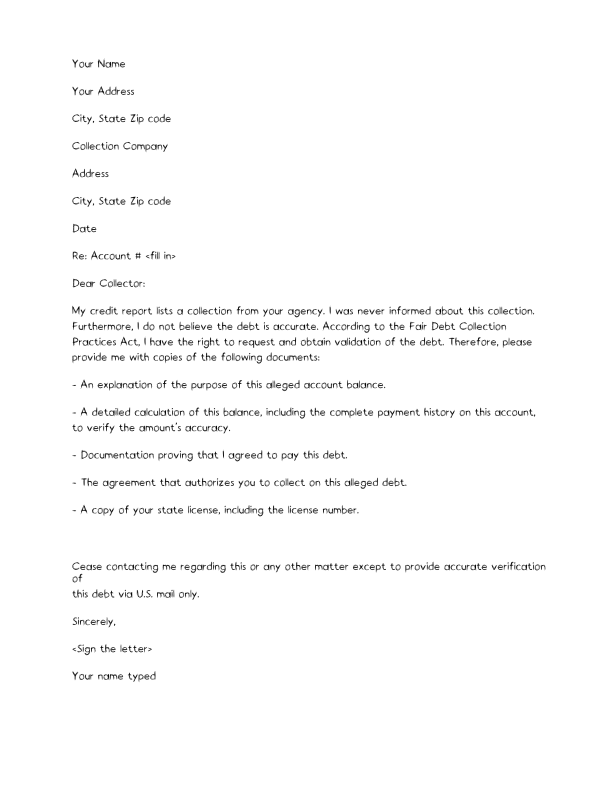

Download Sample Debt Validation Letter

Debt Validation:

You have the right to request debt validation. Debt validation requirements apply exclusively to debt collectors, which include collection agencies that buy debts from original creditors and the internal collection departments of companies. The initial creditor isn’t required to provide comprehensive debt validation. However, they must furnish a copy of the original contract between the parties, such as the credit card agreement or loan document with your signature. Once you request validation of the debt, the collector is required to provide you proof in the form of 5 specific documents:

- A detailed explanation of what the alleged debt is for, ensuring that the debt genuinely belongs to you.

- A complete payment history of the account, including calculations that show how the balance was determined, providing proof that the claimed amount is accurate.

- A copy of the agreement or signed credit application demonstrating that you agreed to pay this debt, confirming it belongs to you rather than someone else with a similar name or in cases of potential forgery.

- A copy of the agreement that authorizes the collection agency to collect on the old debt, applicable if the debt has been sold to a third-party agency, which they are legally allowed to do.

- A copy of the creditor’s state license, including their license number, to verify that they are a legitimate company and not an overseas scammer attempting to collect money unlawfully.

Incomplete Debt Validation

The debt collector must provide the validation within a reasonable period, usually considered 30 to 45 days. If the collector can’t validate the debt by providing you with every document requested stated in the letter, you will be able to remove the collection without paying.

Download Sample Incomplete Debt Validation Letter

The Art of Negotiation:

If you plan on negotiating a settlement, make sure that you include a deletion clause. The agreement should state that: When the receives your payment, the debt is considered “paid as agreed.” In addition, they will report to the credit bureaus to have the collection deleted. If you “paid as agreed” on the account, then it is impossible to have a collection under the account.

Approach negotiations in a professional, rational and calm. Don’t go into a story about your situation. Preferably negotiate over the phone, which allows for more direct communication. Here’s an adaptable script:

-

- Introduce yourself and mention the collection account on your credit report. State the balance and offer a specific amount you can pay immediately, like $1,075 instead of a round number: My name is [your name]. I noticed a collection on my credit report from your company with a balance of $4,500. I want to resolve this, but I’m unable to pay the full amount. I can offer $1,275 as a settlement. If you agree to this amount, I can send a cashier’s check immediately.

At this stage, do not mention what your intentions are. The collector could say, “If you pay less than the full balance, it will show on your credit report,’ which doesn’t look good.” It actually doesn’t matter. They can add a statement if they want. You plan to have the account deleted anyway. Do not tell them yet, though. Let them know, “I’m aware of that, and it’s not a concern for me. Will you accept my offer, or would you rather I pay nothing at all?” Stay focused on the main point: negotiating the settlement amount.

You want to offer low to try and pull out their best offer. Listen to their counteroffer. If it is 50% of the balance is great, most companies will start at 20%. Negotiating a lower settlement usually requires more time. You need to make it clear that you don’t have the cash on hand and won’t be able to obtain it anytime soon.

The collector may say that “Your offer is too low; I cannot accept that.”

You then say, “I’m really sorry to hear that. Because that is all I have. What is the lowest that you can offer me?”

The collector may say, “I can take $2775 as long as you pay that by the end of the month.”

You say, “I have to say, $2,775 is a real reach. Unfortunately, it is not do-able for me. I have very limited resources. What if I can manage to get $2,559. Will you take that?”

The creditor may say, “I’ll take $2100 now and you can pay the rest of the balance next month.”

No payments, because once you put any amount towards the debt other than the full amount, the statute of limitation starts over, and the account is considered late until the balance is paid off.

You say, “No thank you. I want to pay an agreed-upon amount in one payment. That is the only way I’m doing it. I’ll just have to wait until I can save up for the amount we agree on. If that means I have to wait a year or more, than that’s the way it will be.” Then pause, let the time frame soak in. Then continue, ‘However, if we can agree on agreeable amount, I can pay you this month. I’d like to take care of this, but I am not desperate or in a rush. Unless we came up with a do-able sum, there would be no payment at all.”

At this time, they may say, “$2,100 is the lowest I am authorized to go.”

You say, “Please send me a letter saying $2,100 by such-a-date will be paid as agreed. I’ll see about gathering the funds.”

Verbal agreements mean nothing. Once you have a verbal agreement for settlement, always asked for it in writing before going any further.

An emailed letter is acceptable. Save the email in a document that includes the header, showing the sender’s information and the date. It’s crucial to have this letter—no letter, no payment. No exceptions. Do not explain to the creditor why you need the letter; just request a letter stating that the agreed amount will be marked as “paid as agreed.”

Important Strategies:

- Never mention that you’re trying to clean up your credit to buy a car, a house, or to refinance. This signals desperation, and they may demand more money than they otherwise would.

- Avoid rushing to pay the creditor. Instead, let them feel the urgency to propose an acceptable settlement so they can collect their money.

- Don’t fall for threats that the settlement offer will be withdrawn if you don’t pay by a certain date. They always want money, and almost always, they will negotiate if necessary.

- Always propose a specific odd number instead of a round one. For example, offering $1,275 sounds more thoughtful and precise than offering $1,000 or $2,000, indicating you’ve carefully calculated what you can afford.

The Right Way to Pay Off a Collection or Charge-Off

Now that you have the agreement in confirmed in writing you can proceed with payment.

- Use a cashier’s check or money order, do not pay in cash and do not give your bank details. Plus, you want to have a paper trail in case you need it down the road. They will accept a cashier’s check over nothing at all.

- Wherever there is space, write: Paid in Full as Agreed.

- Make photocopies of your check. One is for you to keep and one for the credit bureaus that show a collection on your report.

- Same as above, make photocopies of your check. One is for you to keep and one for the credit bureaus that show a collection on your report.

- Send in the check to the collector, once it’s cashed, send the copies of the agreement letter, cashier’s check to each bureau that shows the collection. Include a cover letter that states: “This collection must be deleted because it was ‘paid in full as agreed.’ By law, you are required to remove this account.”