Disputing Negative Items on Your Credit Report

The majority of the links on our website are affiliate links. This means that if you click on the link and make a purchase, we earn a small commission at no additional cost to you.

4

Understanding the Impact of Closed Accounts on Your Credit Score

On your credit report, you will find both open and closed accounts. Closed accounts can affect your credit score in several ways. Here’s how:

When an account is closed, the credit limit on that account is deducted from your total available credit. This increases your credit utilization ratio, which is the percentage of the amount of credit that you’re using from what is available to use.

For example, if you have three credit cards. Each has a limit of $4,000. The total available credit is $12,000. If you have used $4,000 of the $12,000, your credit utilization is 33%.

If one card with a $4,000 limit is closed, your total available credit drops to $8,000. Your credit utilization jumps to 50%, which will negatively impact your credit score. Experts recommend keeping your credit utilization under 10%. Because you gain points when your score is calculated. 30% is the point when your score will start losing points and the higher the percentage goes, the more point you lose points.

In addition to your credit cards being scored altogether, they are also scored individually. The balance that will earn the most points is $0. However, if there is a $0 on a closed account, it will negatively impact your credit. Closed accounts that read “paid as agreed” is how the status on a closed account should read.

How Credit Utilization and Account Longevity Influence your Credit Score

When an account closes, in addition to credit utilization, the average length of a consumer’s credit history shortens. The length of credit history is a significant factor in determining your credit score. It contributes 15% to your overall FICO credit score. Here’s a breakdown of how this aspect is evaluated:

- Age of Accounts: Credit scoring models consider the age of your oldest credit account, the age of your newest credit account, and the average age of all your accounts. A longer credit history with great payment history generally indicates more experience managing credit, which positively impacts your score.

- Length of Time Accounts Have Been Open: The longer your accounts have been open and in good standing, the better. It shows a history of responsible credit use.

- Time Since Recent Account Activity: Credit scoring models also consider how long it has been since you used each of your accounts. Regular, responsible use of credit is viewed favorably.

The length of credit history accounts for 15% and credit utilization accounts for 30%. These two factors make up almost half of your credit score.

Implications of a Closed Account

A lender will look at a consumer’s credit score to help determine if the applicant is a high risk. In addition, to looking at a credit score, lenders will review a consumer’s credit report. Within your credit report there is information that are red flags for lenders. As an example, if a credit report states that the consumer is working with a credit counseling service or a debt management company. It tells potential lenders that the consumer cannot manage their money. Lenders see this as bad as Chapter 13 bankruptcy.

An account can be closed by the consumer or by the creditor. If your account is closed, you want to be the one who closes the account. A creditor closing an account does not look good to potential lenders. It is a red flag, lenders might interpret that the creditor closed the account due to the consumer’s financial instability or inability to manage credit responsibly. I

To avoid having an account closed due to inactivity, you only need to use your credit card twice every 3 months to keep it active. And the purchase doesn’t need to be expensive. It could be as small as a pack of gum.

A closed account stops earning longevity points, that is what you want, longevity with excellent payment history. That builds strong credit. And you get more points for maintaining a credit account for a long time. However, if a closed account is in good standing with the creditor. It will still be beneficial because it shows a record of timely payments. Your credit payment history accounts for 35% of your credit score. It’s the most influential factor.

It will also help with the age of accounts because remember the scoring model considers the age of the newest account, the age of the oldest account is, and the average age of all your accounts is also considered. Closed accounts will contribute to that factor.

A closed account in good standing reflects well on your ability to manage credit responsibly. Future lenders view this positively as it indicates that you have a history of honoring your credit obligations, even if the account is no longer active.

When to Consider Closing an Account

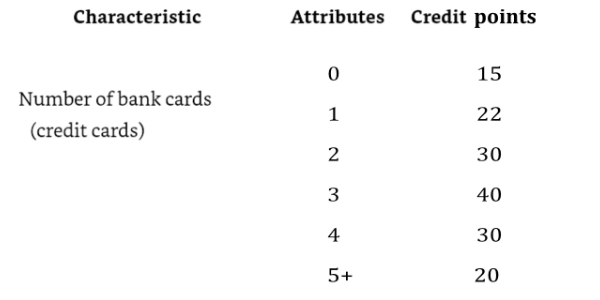

While it’s generally advisable to keep credit accounts open, there are situations where closing an account might be beneficial. As an example, if you have an excessive number of credit cards (e.g., 10), closing a few may be a good idea to maintain a manageable amount of credit. A potential lender doesn’t know how you’ll be able to handle a new line of credit. Everyone has that point where it’s too overwhelming. Having too much credit is not a good thing for potential lenders to see. Three credit cards earns the most points; having more will negatively impact your score. This is just one of many characteristics that determines your credit score.

How to Close a Credit Account Properly:

- Pay Off the Balance: Ensure that the account balance is paid as agreed.

- Notify the Creditor: Contact the creditor to request the account closure.

- Confirm Closure: Obtain a written confirmation that the account has been closed.

- Monitor Your Credit Report: Check your credit report to ensure the account is marked as “closed by consumer” if you initiated the closure.

Handling Negative Items on Closed Accounts

If you have a closed account that is paid off but have negative items, such as a balance showing that you already paid off and late payments. This account is hurting your score and will look bad when a potential lender reads your credit report. This type of account needs to go.

But you never want to write that the balance is wrong. What do you want to write? “The account is reporting false information.” Whatever the issue is, reference it as “an account that is reporting false information”. In which case you have the right to demand deletion.

That is a true statement that is based on the law. Don’t write about your struggles. Don’t send a goodwill letter and risk the chance of saying too much and admitting the account to be yours.

Your dispute letter is not disputing the account or negative item as being yours because that could be a lie. Your letter is disputing the fact that false information was reported and posted on your report. You see any information that is added to a consumer’s credit file must be verified as accurate.

In other words, if I open up a credit line. The creditor is going to report the account to the credit bureau. When the credit bureau receives notice of a new account. They must verify that the consumer did indeed open up a new account. Before it is added to their file.

The law doesn’t say that derogatory accounts must remain on your credit report for a period of 7 years. It only limits the amount of time they can be visible on your credit report. So, removing derogatory accounts is 100% legal.

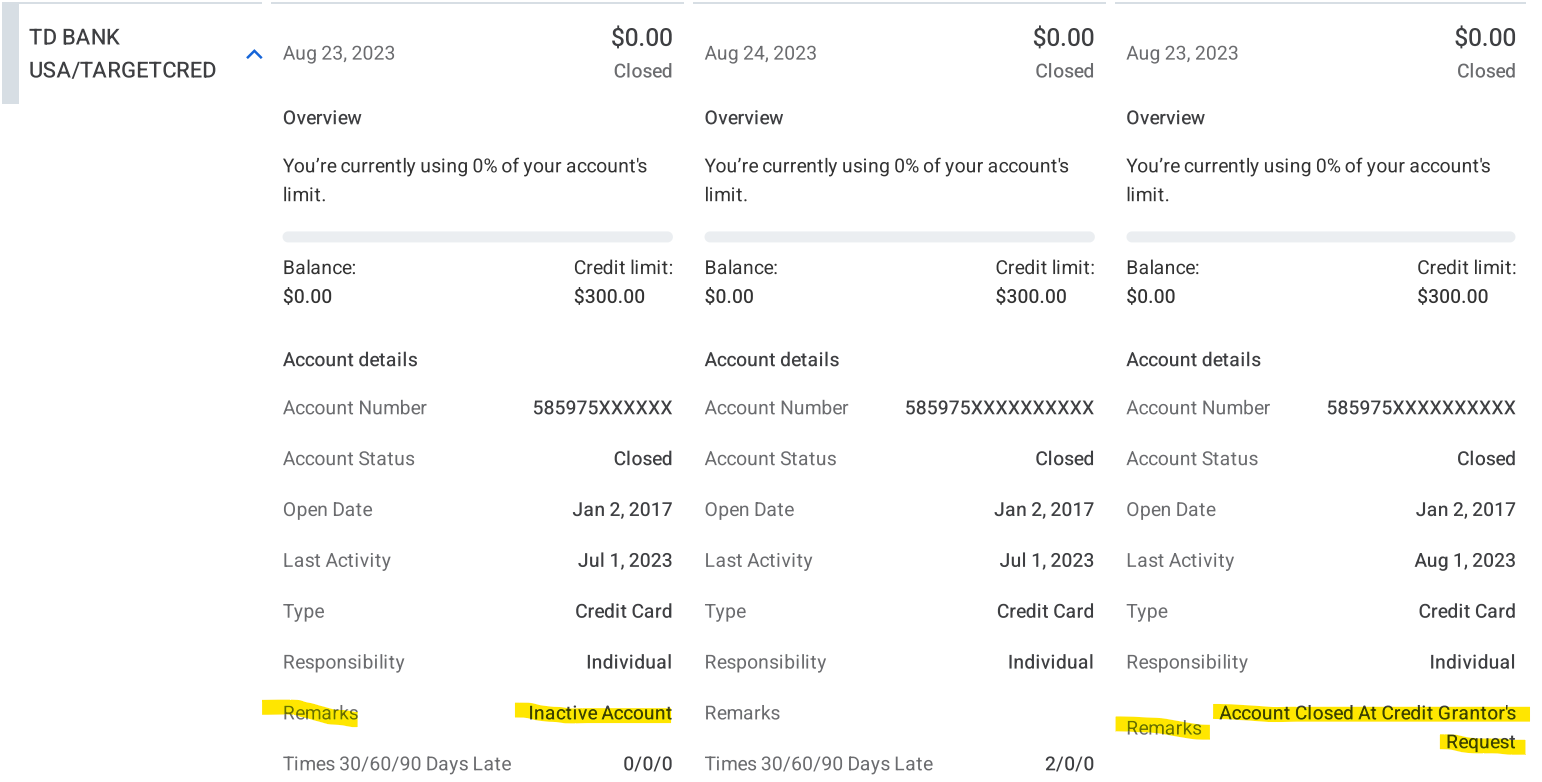

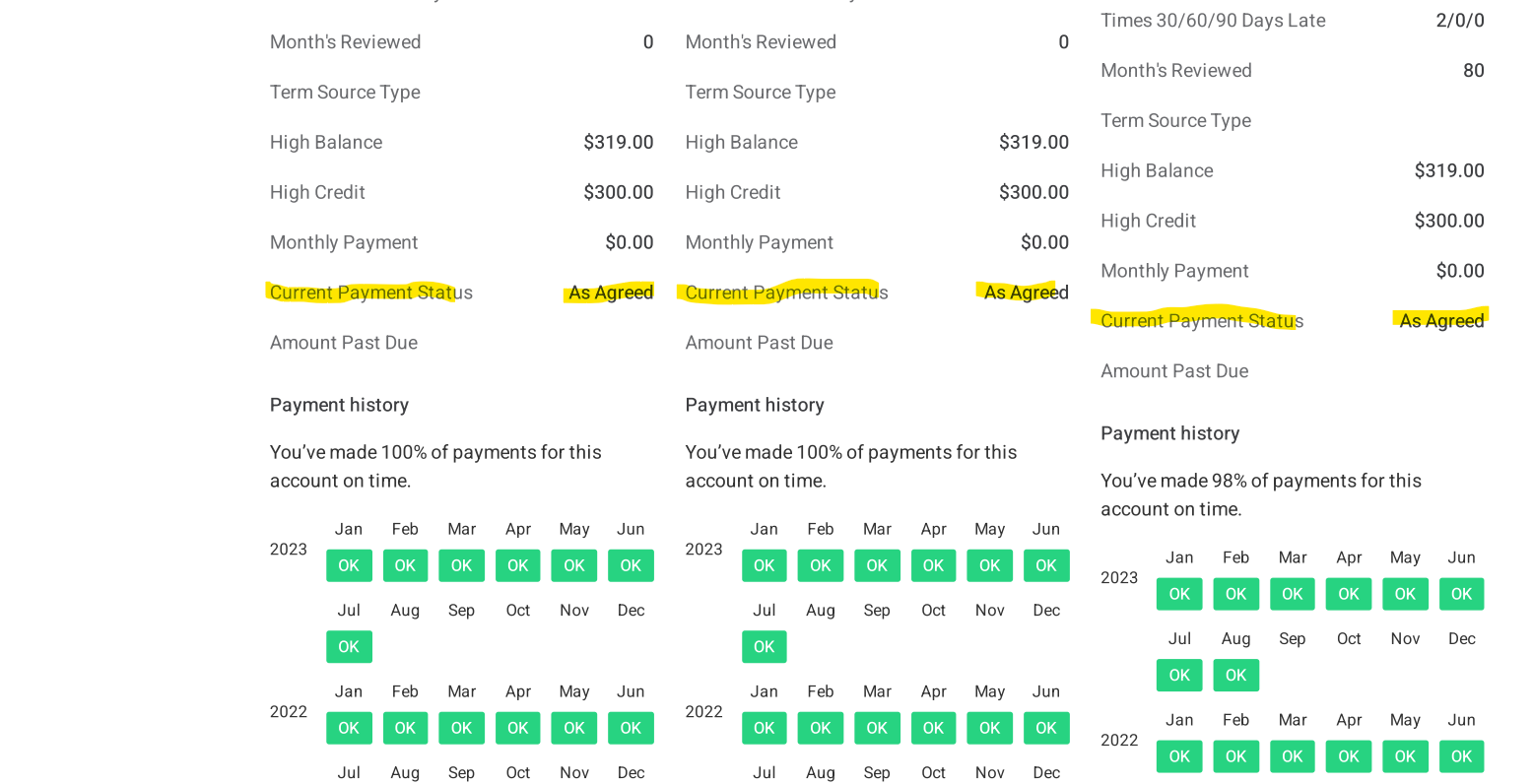

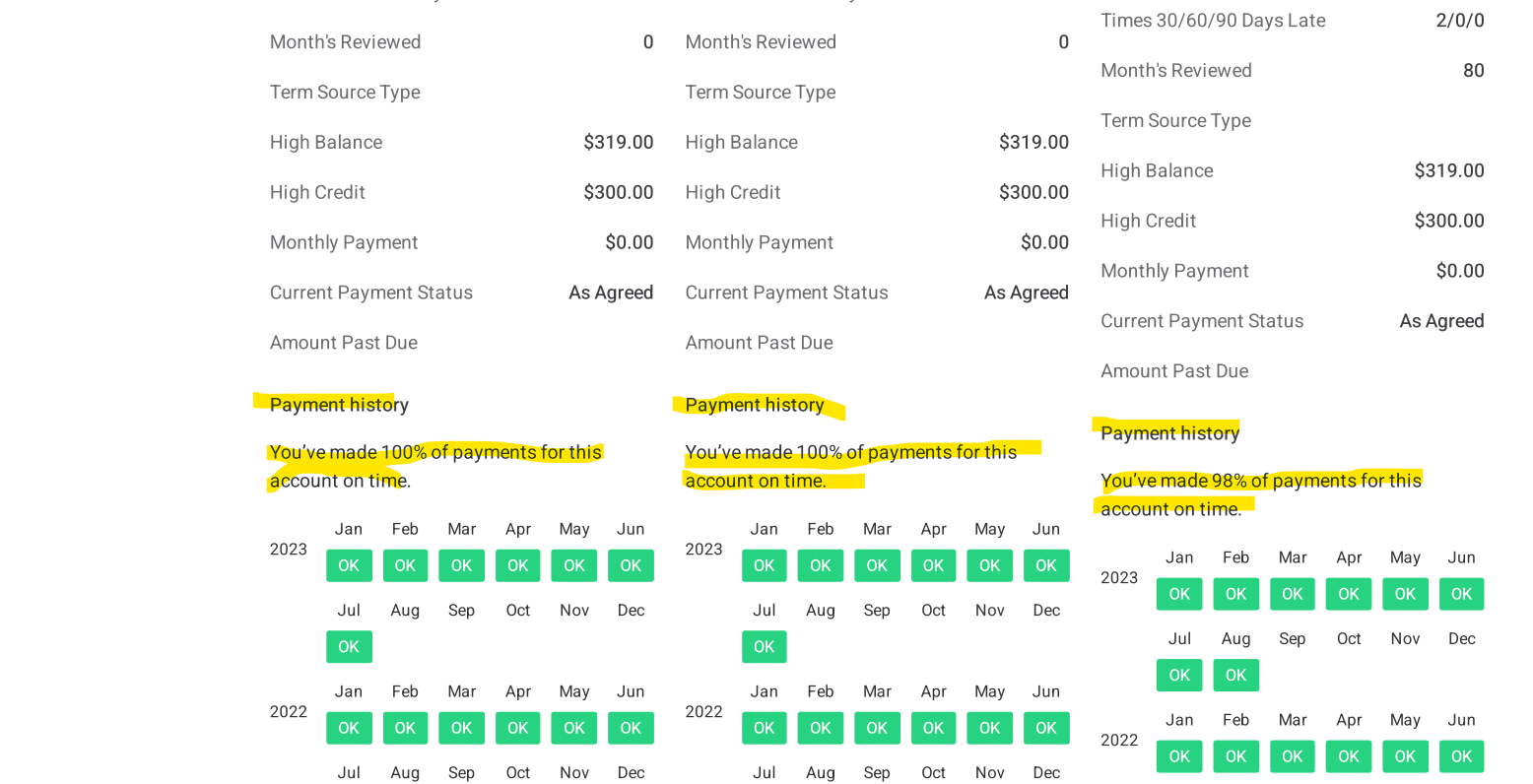

Take a look at this Target account from my reports. There are 3 columns, each one represents a different credit bureau. The account is paid off and closed. You can see that this account has 2 late payments that occurred in 2018. They hurt my score whenever it is calculated. Also, the account was closed by the creditor. Remember that is not good for potential lenders to see.

The payment status is “as agreed”. That is what you want the payment status on closed accounts to read. The payment history is almost perfect. That will help when my score is calculated. Because of the payment history, I want to keep this account listed.

If I was going to have this account deleted, I would send the letter to the credit bureau first. The rule of thumb is to challenge the credit bureaus first and creditors second.

Remember the previous step we sent the letter to the credit bureau. Assuming we received a verification letter. We would send a letter to the creditor next because they reported the information. They will need to prove it or delete it. Those are the only choices they have.

You want your letter to depict you as an honest person who is astonished to find an error on your credit report. And because the law allows you to exercise your rights and demand an account with false information posted, be deleted. That is what the letter is instructing them to do. Because your credit is very important to you and don’t want your credit to be negatively impacted. Versus someone who hired a service to remove a list of derogatory items.

letter to creditor to remove negative item from report

Identifying and Correcting Errors in Your Credit Report

Is there anything wrong with the account, maybe there’s a zero that should be the letter O. Maybe the date is wrong. A common error is a balance showing on a paid off account. When the creditor sells an account, they don’t own the account and cannot collect money on the account anymore. The balance should show $0.

The Target account shows $0 for the balance. The fact is I will keep the Target account because the payment history will help my credit score.

But I will use it as an example. If I wanted to have it deleted because of the two 30-days late payments, I would look for a factual error.

You want to look for any false information. In a previous step you had chosen a form of your legal name you were going to use going forward. Any other names listed on your credit report; you had them deleted.

Check to see what name is tied to the account with the negative item. If the name tied to the account is not your chosen name, the information on the account is false. You can demand deletion of the account.

You also had addresses removed. What address is the account tied to. If it is tied to an address that was deleted, the information is is now false.

When reviewing your three credit reports, it is important to directly compare them side by side to ensure that they are accurate and consistent. Discrepancies may occur during this examination. Let’s use the target account as an example.

Again, each column is a different credit bureau. The creditor is Target, same account, same creditor. The credit bureaus will not know anything that isn’t reported to them. Because of this, I can understand if Experian didn’t show my Target account on their report. I can make the assumption that the creditor reports only to Equifax and TransUnion.

However, if the creditor is reporting to all three credit bureaus, as Target does, I expect the information to be the same across the board. If Target reported to TransUnion and Equifax that; “I had made 100% of payments for this account on time”. What should I expect Target to report to Experian? I expect to see the same post, right?

Experian shows that Target reported that; “I had made 98% of payments for this account on time”. This my friend is inconsistent reporting. This leads to discrepancies in my credit reports, which is going to affect my credit score and lending decisions. Since it is the same account only one of the two different statements can be true. If I didn’t compare the three reports side by side, I never would have caught this error.

Credit repair is not a straight line. You may need to adjust to make sense for your situation. For example, in this step we are sending a letter to the creditor. But for this discrepancy, I would send a letter to the credit bureaus before I send a letter to the creditor. Because the creditor could make the correction needed and then tell the credit bureaus to make the change in their records.

When I provide screenshot copies of the account from my report and point out that contradictory statements have been reported and posted to my file. I demand the account be deleted. There isn’t any proof that can be provided that will make the contradictory statements true at the same time. I am sure that there is a simple explanation why this error occurred.

But that isn’t the issue anymore, the problem is that the report is misleading for potential lenders. The quick and easy option is to delete the account. And the creditor won’t have to be bothered with this error.

It’s a closed, paid off account. It does not hurt the creditor at all if the credit bureaus delete to the account. Whereas this does hurt my credit by having it remain.

In reality, the payment history on the account outweighs the two 30-days late payments. So, I am going to leave this account as is.

You will have twists and turns that don’t follow the fundamental steps of the disputing process. A step might be sending the letter the furnisher, but a situation may have a better chance of success if the letter is sent to the credit bureau.

Back to the step, in the letter I would include screenshots from the three reports that show the contradictory statements, printed out so I can place into the envelope before sealing it. Pointing out the inconsistent reporting in the letter and demand deletion of the account reporting false information.

By this time the letter has been sent and received by the creditor. Generally, the creditor has the proof of verification somewhere in their records. The question is, does the creditor have the time to search their records for verification? Time is money for them. They may not have the time to go searching, or it might be too much of a hassle for them. Deleting the information will be less of an inconvenience.

Now your credit history with the creditor will come into play. If you have a great history, it would be better to keep you happy and delete the information. That could result in you applying and opening a new account, using credit, and the creditor makes money in the long run.

If you have multiple late payments on the account, expect the creditor to dig through their records and find the proof. Your next move is to wait for a response to your letter.

Letter for Closed Paid Off Account

Handling Late Payments on An Open Account

Make sure you are not behind on any credit card or loan payments before attempting to remove late payments from an active account. Prioritize catching up on any outstanding payments and maintaining a regular schedule of paying on time. This step is essential as it becomes challenging to dispute past late payments if you continue to be late in your current payments.

Compare all three reports against each other and check for any discrepancies within the three reports, like I did above, before you send any letters.

If you have one late payment that is older than two years, and the rest of your credit is perfect, you could leave it alone. Because it isn’t hurting your score as it did the first two years. The longer it has been since the negative event occurred, the less and less damage it will do.

But if you want it gone, if you have proof to show you weren’t late, get it. I know the burden of proof is on the creditor, but honestly the burden of proof is on both parties. The proof can be the bank statement showing the funds being withdrawn.

If you lack evidence and have a single late payment with an otherwise flawless report. It is out of character for you. Your report indicates that this late payment is an anomaly. You do not typically have a track record of late payments.

The obstacle you face is the one who reads your letter. What if the representative is the type that dictates the law to borrowers? The law says that inaccurate data cannot be added to a consumer’s file. And accurate data cannot be deleted. Therefore, the information on file must be accurate.

To ensure your letter reaches the appropriate person, consider identifying the individual responsible for handling customer complaints.

- You can locate this information on the company’s website,

- Conduct a Google search using the company name + “file a complaint,”

- Or contact their customer service hotline for assistance.

Once you find the name, address the letter to that specific individual, ensuring you spell their name correctly. Avoid using generic salutations like “Dear Sir or Madam.” If the name is unavailable, you can opt for “Dear Executive.” If your handwriting is clear, consider writing the letter by hand.

The letter you send should be non-threatening and complimentary, expressing appreciation for their service. As a loyal customer, you anticipate continuing to support their business. As you conclude the letter, make it clear to the recipient that your business dealings with them are paused until the inaccurate information is deleted.

Again, your credit history will come into play. If you’re a long-time customer with a good history, it makes more sense to delete the late payment to keep a loyal customer and the creditor is able to keep your credit line open for use, everyone wins.

Unfortunately, I cannot guarantee this outcome. If you are denied, that’s fine, move onto the next step. If the creditor is Capitol One, challenge the late payment with the credit bureaus instead. Because Capitol one will not delete a late payment.

Multiple Late Payments And Covid

If you experienced late payments during the pandemic due to illness or job impact, the CARES Act might have prevented these from being reported. A legal clause could be applicable in this context. Below is a sample letter for such circumstances.

This letter will be directed to the credit bureaus responsible for listing the late payments on your report. It is advisable to send this letter via certified mail to obtain a receipt upon their acknowledgment of receiving and signing for it. The bureaus are required to furnish you with proof within 45 days. Once they acknowledge receipt by signing for it, they are legally bound to address it and cannot claim they did not receive it. Keeping the receipt of their signature handy will be beneficial if needed.

Tips for deleting late payments

- When addressing multiple late payments: Dispute one account at a time per credit bureau if you have late payments on several accounts.

- Maintain professionalism and politeness: Ensure your letters are professional and courteous.

- Use friendly language: End your letter with a warm closing like “Thank you in advance” and start with a friendly greeting such as “I hope you are well.

- Providing documentation to credit bureaus: Update your personal information and include three to five identification documents displaying your correct name and address to improve the chances of deletion. It’s been proven by credit repair businesses that including several pieces of ID helps obtain the deletion.

- Organize your correspondence: Create a system, like a dedicated folder on your computer, to store all your communications, relevant documents, and screenshot images in one place.