Kikoff Credit: Build Your Credit Fast

The majority of the links on our website are affiliate links. This means that if you click on the link and make a purchase, we earn a small commission at no additional cost to you.

How to Build Your Credit with Kikoff: A Comprehensive Guide

Building a strong credit score is crucial for financial stability, and Kikoff offers a straightforward service designed to help individuals establish or improve their credit. If you’re looking for a programmatic way to boost your credit score with Kikoff, here’s everything you need to know to make the most out of their service.

What is Kikoff?

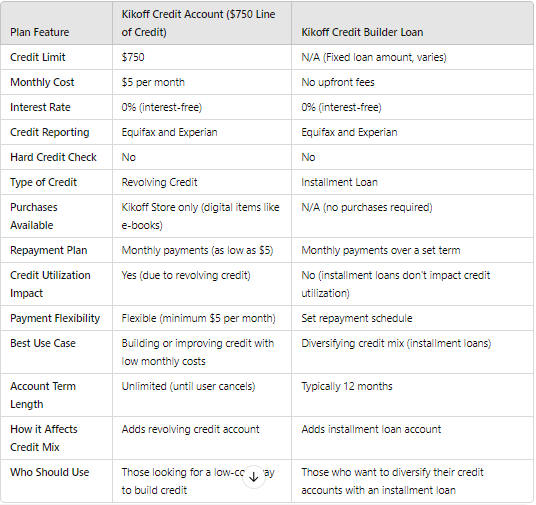

Kikoff credit is a credit-building platform aimed at helping users with no credit or poor credit scores improve their financial health. Kikoff reports monthly payments to two major credit bureaus: Equifax and Experian, which means your on-time payments will help you build credit over time. Kikoff’s key feature is its $750 revolving line of credit, which users can access for $5 per month with 0% interest.

In otherwards, you agree to a contract that is for a year. Each month you pay $5. You have a balance of $60 at the start and every month, your $5 payment deducts from the balance. The credit account comes with a credit limit of $750 with the basic plan. You can use the $750 at the Kikoff store to purchase a variety of digital products. Whatever is spent is added to the $5 monthly payment. Whether or not you use any of the $750 in credit, you still make a $5 payment.

How Does Kikoff Work?

Kikoff operates by giving you a revolving line of credit that you can use to make small purchases in their online store. Here’s a step-by-step breakdown of how you can successfully use Kikoff’s services:

- Sign Up for Kikoff: Signing up is easy and requires basic personal information. Kikoff does not conduct a hard credit inquiry, so signing up will not affect your credit score.

- Access the $750 Line of Credit: Once approved, Kikoff grants you access to a $750 line of credit that you can use for purchases in their store. You are required to make small payments on your purchases. Each payment is reported to credit bureaus, which helps build your credit profile.

- Make a Small Purchase: To keep your credit utilization low (a major factor in credit score calculation), make a small purchase from Kikoff’s online store, which offers items like e-books and courses. A low credit utilization rate is generally under 30%, but to maximize impact, you might want to aim for 10% or lower.

- Set Up Automatic Payments: To avoid missing payments, which can hurt your credit, set up automatic payments through the Kikoff app. Since you are only required to pay $5 per month, keeping up with payments should be manageable for most users.

- Monitor Your Progress: Kikoff provides users with a credit score dashboard so you can see how your score changes over time. Keep an eye on your score to monitor improvements as your positive payment history is reported to the credit bureaus.

How Kikoff Impacts Your Credit Score

Credit scores are primarily based on five key factors:

- Payment History (35%): Making on-time payments is the most important factor in your credit score. By paying your Kikoff bill on time each month, you can boost this part of your score.

- Credit Utilization (30%): This is the amount of credit you’re using compared to your total credit limit. By only using a small portion of the $750 line of credit, you can improve your credit utilization ratio, which positively affects your score.

- Length of Credit History (15%): If you keep your Kikoff account active for a long period, it will increase the length of your credit history, which can positively influence your score.

- New Credit (10%): Kikoff doesn’t perform a hard credit inquiry when you sign up, so opening an account won’t negatively impact this factor.

- Credit Mix (10%): Having different types of credit accounts (credit cards, loans, etc.) is good for your credit score. Kikoff adds a revolving credit account to your profile, helping diversify your credit mix.

Best Practices for Success with Kikoff

To get the most out of Kikoff’s credit-building service, follow these best practices:

- Keep Your Credit Utilization Low: Ideally, keep your usage below 10% of the $750 line of credit. This shows that you are responsible with credit and can help boost your score more effectively.

- Never Miss a Payment: Late payments can severely damage your credit score. Even though the payments are small, always make them on time to ensure you build a positive payment history.

- Use Kikoff for at Least Six Months: While you might see small improvements to your score within a few months, credit-building is a long-term process. Keep your account active for at least six months or longer to maximize the positive effects on your credit profile.

- Monitor Your Credit Reports: Regularly check your credit reports from Equifax and Experian to ensure that Kikoff is reporting your payments accurately. You can get a free credit report from each bureau once per year at annualcreditreport.com.

Who Should Use Kikoff?

Kikoff is a good fit for anyone looking to:

- Build or rebuild their credit without taking on major debt.

- Improve their credit profile without undergoing a hard credit inquiry.

- Establish a positive payment history with little financial risk.

Because of its low-cost and 0% interest model, Kikoff is especially ideal for people just starting their credit-building journey or for those who have damaged credit and want a safe, easy way to rebuild.

Conclusion

Kikoff is a practical and low-risk way to build your credit score, especially if you follow a disciplined approach to credit management. By making small purchases, keeping your credit utilization low, and paying on time, you can steadily improve your credit profile and open doors to better financial opportunities.

Use Kikoff strategically and combine it with good financial habits to achieve the best results, and soon you’ll see positive changes in your credit score.

By following these steps and using Kikoff wisely, you can build or improve your credit score effectively.

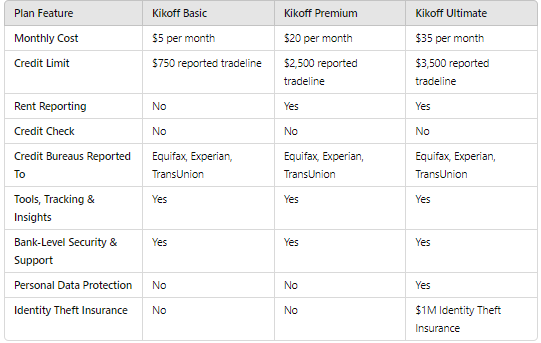

Here’s a detailed table for Kikoff’s credit account plans based on available information:

Here’s a table detailing the features of the Kikoff Basic, Premium, and Ultimate plans: