fvdqfqmy

E OSCAR System How Does It Function

E OSCAR (Online Solution for Complete and Accurate Reporting)

How An Investigation is conducted

What do you think of when you hear or see the word “investigation”? Probably somewhere along the lines of document review, fact research, interviews with both parties, and handwriting comparison. Here is an example, these are some of the duties a fraud investigator would perform for Zales Jewelers:

- Securing original documents, such as the credit application, sales slips, and any written accounts from store staff.

- Obtaining copies of identification documents and police reports.

- Analyzing the signatures on the sales slip and the credit application.

- Conducting interviews with store employees, including the manager and the sales associate involved in the transaction.

- Drafting statements for store employees to endorse or recording notes during interviews.

- Questioning the fraud victim to collect more details that may aid in identifying a suspect or understanding the nature of the fraud or forgery.

That sounds about right. How much do you think this investigation would cost Zales Jewelers? How long do you think it would take to complete the investigation? Keep those two questions in mind. Now you probably do not want to know what you’re going to read. But even though it sounds like bad news, you can use this information to your advantage.

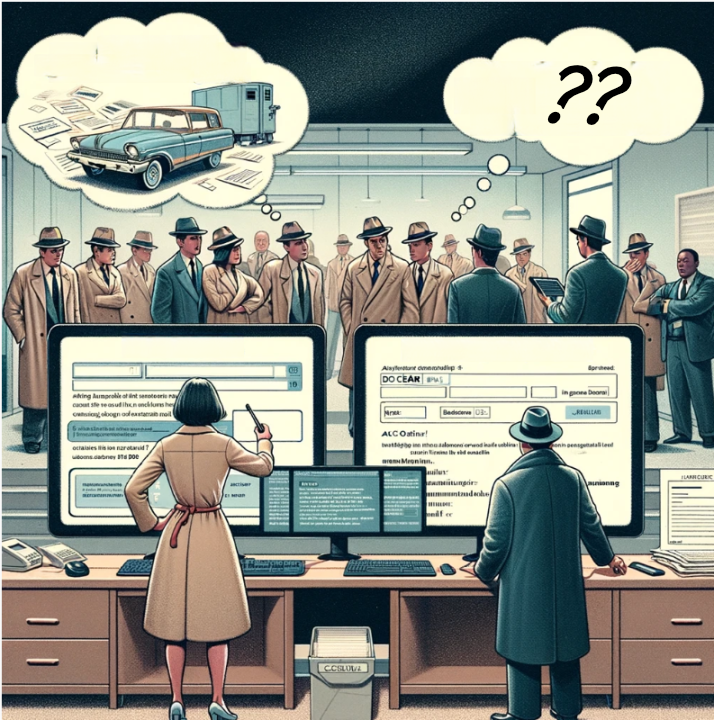

The E-OSCAR system, was created, designed and deployed by the credit bureaus. It summarizes detailed dispute letters into dispute codes. This highly automated and computer-driven process uses an electronic form called an Automated Consumer Dispute Verification (ACDV) form. This is the only form of communication between the credit bureaus and the furnishers.

Key Points of the e-OSCAR Process:

- Automated Dispute Forms: The ACDV form, streamlines the dispute into one- or two-digit codes that represents the consumer’s detailed concerns.

- Limited Interaction: Initiated through an online system, e-OSCAR diminishes the human element in processing disputes. At first there were 100 codes that were available to choose from. Today the number of available options is 26 and E-OSCAR is heavily dependent on the dispute codes to categorize and communicate issues.

- Loss of Supporting Documents: Supporting documentation, like billing statements and letters from consumers, which provide substantial proof of disputes, are not passed along when the codes are sent to furnishers.

- Codes Usage: Three of the twenty-six dispute codes are used for majority of disputes. The details of each individual dispute are not addressed. With such a complex system, three dispute codes cannot cover the spectrum of issues that consumers have.

Disadvantages Highlighted:

- Inadequate Responses: Following a quick investigation with a minimum effort, consumers receive generic responses from the credit bureaus that are meaningless. They lack details, justification, and explanation of the findings. They are not required to provide written explanation of their investigations. It is only when the consumer requests written details of their findings is when they are required to provide written explanation.

- Limited Categorization and Generic Notices: Examples from court cases reveal how responses from the bureaus fail to address specific consumer disputes. The results are generic notifications that do not resolve or appropriately acknowledge the issues raised by the consumers.

You need to understand the rights that consumers have. Under the Fair Credit Reporting Act (FCRA), you have certain automatic rights, but many key protections only kick in if you actively pursue them. Here’s a breakdown:

Automatic Rights:

- Dispute Process: If you challenge an error on your credit report, the credit agency must investigate it within 30 days.

- Notification of Adverse Actions: If a decision negatively affects you (like being denied a loan or job) based on your credit report, you’ll automatically be notified, including who provided the report.

- Reinsertion Notice: If something that was removed from your report gets put back, the agency must inform you within five days.

Rights that Require Your Action:

- Seeing Your Credit Report: You must request a copy to see the outcome of a dispute or the current state of your report.

- Verification Requests: If you need more details about specific items on your report, you must ask for this in “writing”.

- Free Credit Reports: After a fraud alert, you must ask for your free reports; they aren’t sent automatically. You’re entitled to one free report per year from each major agency, but you need to request additional ones.

- Adding a Statement of Dispute: If you’re not happy with how a dispute was resolved, you must ask to add a statement to your file.

What You Could Lose by Not Acting:

- Not Disputing Errors: If you don’t challenge errors, they won’t be corrected, which could keep harming your credit.

- Ignoring Notifications: Not following up on adverse actions or reinserted items could mean missing chances to correct them.

- Not Requesting Detailed Information: Failing to ask for verification or details about disputes could leave you without essential info needed to challenge inaccuracies.

In short, while the law gives you some automatic protections, you need to be proactive to make the most of your rights under the FCRA. Not taking action can lead to missed opportunities to fix issues on your credit report.

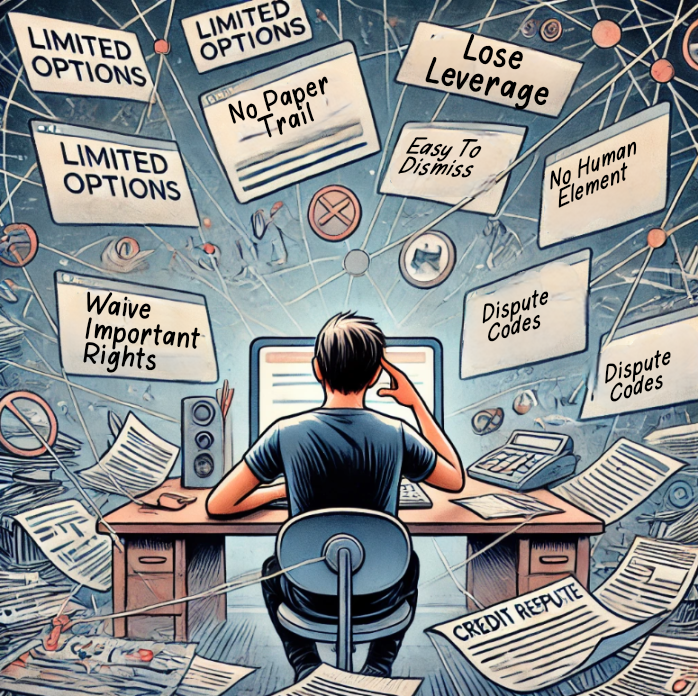

Online Credit Disputing: A Cautionary Guide

E OSCAR system revolves around the standardized dispute codes. The only reason E OSCAR was created, was to eliminate disputes as fast as possible. Because the credit bureaus receive thousands of dispute letters daily. They cannot possibly address them all. However, the FCRA legally requires the credit bureaus to investigate all disputes. Some letters are lost, ignored, and mishandled. The high volume of disputes overwhelms the system and staff. Here is the catch, the credit bureaus claim that their careless investigations under the FCRA is because of frivolous disputes from credit repair organizations. Who make guarantees to consumers to be able to delete accurate negative information from credit files. Only 30% of disputes at credit bureaus are linked to such cases so that claim doesn’t hold any weight.

The Economics of Credit Reporting

A. Identifying the Customer

Do not think that the credit bureaus are looking out for consumers’ best interest. They are a business, and their main clients are the creditors. Creditors have access to their databases and use the data to market financial products to very targeted consumers. That is why a creditor decides to report their information to the credit bureau. The credit bureaus have reporting fees. They generate revenue in other ways, for instance, credit monitoring services. But the furnishers is where they generate more revenue.

Consumers unfortunately, are caught up in the mix of the relationship between the creditor and the credit bureaus. Consumers have no say so about the data about them, being in their databases. We cannot have them remove the data from their databases and for the majority of Americans, establishing a credit history is essential for significant life events. The purchasing of a house, funding an education, or purchasing an automobile. The data in their databases about consumers will impact many other areas of life. We, consumers cannot walk away with the information if we do not like how the information on us is being handled. The creditor owns the information.

The creditor, on the other hand, can take their business elsewhere. So, if a creditor only reports to Experian and their credit dispute investigations are thorough like Zales fraud investigations and the outcome results in favor of the consumer. Experian will ruin their customers’ ability to collect. Ultimately losing profits for their customer and driving them away. If it comes down to siding with the furnisher or siding with the consumer, who do you think the credit bureau is going to side with?

Credit disputes are also costly. Whatever the cost of a Zales fraud investigation is, multiply that by 1000. The expense is going to offset any profit made. E-OSCAR system is the credit bureaus way of reducing business expenses. Do you ever wonder what the terms and conditions are, when you use online disputing? Before you open a dispute, you must agree to their terms and conditions. It’s never straightforward, but at the end of the day, the consumer agrees to waive their right to request written details of the investigation. And cannot challenge the outcome if it is not in their favor. Those are the most important rights that a consumer can exercise. There is a good chance that your online dispute will be misclassified because there isn’t any human judgement, interaction or common sense. And the credit bureaus don’t have IT techs that will dive into the systems files and correctly classify a dispute. In fact, trying to correct a misclassified dispute is perceived as gaming the system, which leads to the dispute getting flagged as frivolous. There is no paper trail and no evidence of negligence when disputing online. You want your letters to have human interaction. The credit experts only dispute through U.S. Postal Service, so we will follow their lead.

Key Concerns with Online Disputing:

- Limited Consumer Rights: Engaging in online disputes often involves accepting terms and conditions that waive crucial consumer protections. Online systems, including terms of service that users rarely read, can strip you of the right to a detailed explanation of the investigation process and allow the reinsertion of negative items with little to no recourse.

- Inefficiency and Rights Waiver: Online disputing formats like E-OSCAR, designed to streamline bureau processes, tend to oversimplify disputes into numerical codes that can misrepresent the specifics of a dispute case. This digitization lacks human judgment, potentially leading to unresolved or misclassified disputes.

- Lack of Supporting Evidence: The online format does not allow for the attachment of supporting documents, which can lead genuine disputes to be dismissed as “frivolous or irrelevant.”

Credit Scores vs. Credit Reports: The FCRA guarantees free access to your credit report once per year from each of the three major credit bureaus, but it does not cover free access to your credit scores. These are often available at a cost or through credit monitoring services.

Avoid Free Credit Score Websites: Obtaining your credit report from websites offering free credit scores will not be accurate. Numerous third-party sites are known to inflate scores, potentially leading to disappointment. They sign you up for costly credit monitoring services that will not justify the expense. They are only good for monitoring the progress of improving your credit score. Because they are not FICO scores and are always off by decent number of points.

In addition, the only credit scores that are available to the public for purchasing are consumer credit scores. Creditors use FICO’s consumer credit scoring model and credit monitoring service websites use their own scoring models that aim to produce the same results as FICO but do not. The standard for credit scoring is FICO. And their scoring models are proprietary. FICO also has industry specific scoring models that lenders use.

You do not want to rely on consumer credit scores when applying for a mortgage. There are unique aspects of mortgage lending that are taken into account when credit scores are calculated that other types of credit do not. The same goes for the automobile industry. The scoring models aren’t as lenient as the consumer credit scoring model.

This is why you want to focus on the quality of your credit report and do not focus on credit scores.

So, if you wrote a letter that stated any of the above codes. Sent it in with your forms of identification, the dispute is going to be determined as frivolous. And that is basically what is being sent to the furnisher by the investigator except the codes are in numerical form.

Among the major credit bureaus, only Experian handles consumer disputes within the United States. However, Experian doesn’t train their employees to do investigative -type duties.

TransUnion manages its disputes in its consumer relations facility near Philadelphia. The disputes are digitized and then sent to Intelenet in Mumbai, India. This subcontractor gets direct access to TransUnion’s database. The vendors can retrieve consumer credit files and work the Automated Consumer Dispute Verification (ACDV) form. The form includes the consumers personal identifiers to make sure it is the correct consumer. The vendors are required to pick the dispute code listed on the electronic form that best describes the issue and sends it to the furnisher to start an investigation.

Furnishers’ Inadequate Investigations Exacerbate System Flaws

The e-OSCAR system is completely automated unless you dispute through the U.S mail. Then your dispute is funneled into the E-OCAR system a different way. The credit bureaus dispute investigator pass along the electronic form disputes to furnishers. Generally, furnishers only confirm the existence of disputed information rather than thoroughly investigating the claims. They tend to overlook the core issues, fail to review documents, or interact with consumers. Their process involves checking that the data on the Automated Consumer Dispute Verification (ACDV) matches their records before verifying the information as accurate to the credit bureaus. This system allows furnishers to easily validate disputed information without comprehensive verification, thus continuing the pattern of inadequate dispute resolution.

Transmitting Essential Dispute Details: A Failure in the Credit Reporting Process

The Fair Credit Reporting Act (FCRA) requires credit bureaus to include “all relevant information” provided by the consumer in the dispute notice sent to furnishers. However, the e-OSCAR system doesn’t have any feature to attached any supporting documents. And failing to forward key supporting documents such as account applications and billing statements that could decisively support the consumer’s position.

Although the FTC and Federal Reserve Board acknowledge that the exclusion of actual documents can result in incorrect dispute resolutions, no measures have been implemented to revise the bureaus’ practices. The credit bureaus have added the “FCRA Relevant Information field” to the electronic form. The field holds enough characters to include a one-line sentence for any comments relevant to the dispute. But it is only used in less than 10% of cases.

The failure to adequately convey dispute details and documents significantly undermines consumers’ rights and their ability to compel furnishers to conduct thorough investigations. It provides more room for disputes to be determined as frivolous.

How Long Does It Take To Build Credit From Nothing

A credit card is generally more practical and beneficial to begin building credit with. Because credit cards offer flexibility, helps build a credit history efficiently, and allows you to manage smaller amounts of debt. However, they are considered the riskiest of credit types. The interest rates are high to start with because of the risk.

A credit account that has been opened for 6 months, used a least once in those 6 months, the account is not in dispute for accuracy will receive a credit score when the credit file is pulled.

Someone who barely ever uses credit, pays the balance in full, on time when they do use it. Depending on how many trade lines they have, within a year they will have a good credit score. Three trade lines that have been paid as agreed on time and maintains a low usage ratio for one year will have an excellent credit score. It takes only one month to blow it. One late payment will drastically drop your credit score. Building credit is ongoing, positive credit events have little impact to credit files. That is why it takes time to build. Negative credit events severely impact credit files. One late payment has the potential of losing 60-110 points from a credit score.

There is not a set number of points a negative event will lose. It depends on how the rest of the credit file looks. High credit scores will lose more points than lower credit scores. A high credit score reflects a long history of responsible credit behavior, including timely payments, low credit utilization, and a balanced mix of credit accounts. The credit scoring models assume that any negative behavior increases the risk of the borrower. But someone with low credit scores already reflects risk. So since higher credit scores indicate great credit behavior, they are penalized more for out of the norm negative events. However, getting back on track with timely payments will not take as long to recover.

You also do not want to have too much credit because it becomes difficult to maintain good credit behavior. Timely payments, low credit utilization, and a balanced mix of credit accounts is what demonstrates that.

Lenders want to see this type of behavior done with a mix of credit types. 10% of your credit score considers the types of credit being used.

Three accounts that includes 2 credit cards and an auto loan will earn more points than three credit card accounts.

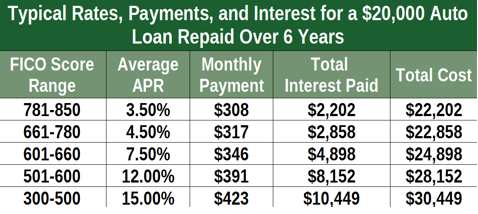

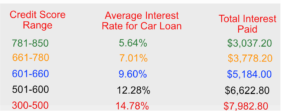

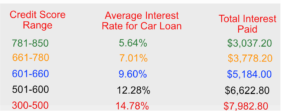

The perfect mix of credit is three credit cards, installment loan, and a mortgage. The three credit cards and installment loan in good standing will give you a credit score that will earn you the best home loans. To get an idea of the difference of cost for great credit scores and low credit scores. But there’s more than the credit score. The score is the result of the credit report.

The Credit Report

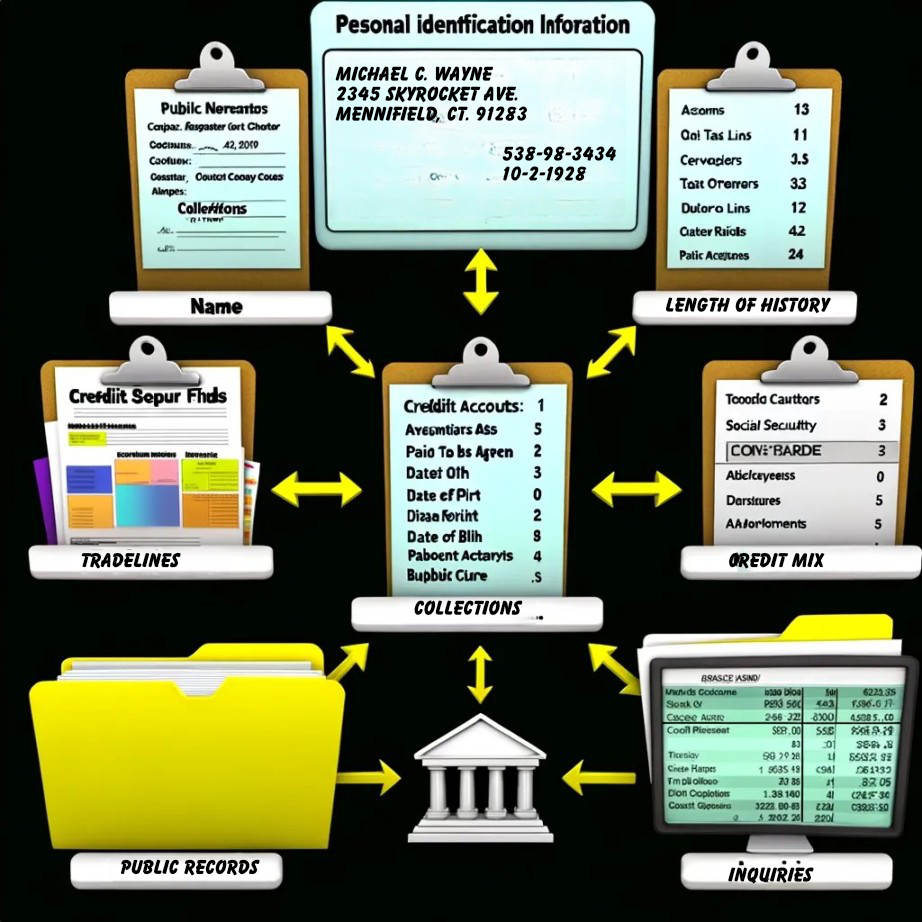

A credit report has 5 types of information about a consumer:

- Personal identification data– Name, date of birth, social security number, addresses and phone numbers. You want to have only one form of your name listed on your credit report. With the least number of addresses. In terms of credit scoring, having more than one variation of your name will affect your score suggesting instability. Lenders start to think if the consumer is trying to hide from something because of aliases. The most common form is first name, middle initial, and last name.

- Tradelines– These are your accounts like credit cards you have open, student loans, and home loans. This section is the bulk of information influencing your credit score. It is the consumers track record.

- Collections– If you have any account that has been sold to a collection company, this section will show that. The creditor cannot collect or accept money for the debt anymore, but you still owe the debt. When a charge-off turns into a collection, your score could take a hit twice.

- Public records- This section is reserved for bankruptcies and foreclosures. This section also impacts a credit score negatively. Tax liens and judgements used to show under the public records section.

- Inquiries –Requests made by a lender, creditor, or another party to review your credit report.

Types of credit lines

Understanding the different types of credit can help you make more informed financial decisions and choose the right type of credit for your needs.

These are the 3 main types of credit. There are other types but overlap with the 3 main types.

Revolving credit: (e.g., Credit Cards – Visa, Mastercard) You have a credit limit, and you can use up to that limit. You make payments based on the amount you’ve used, and as you pay off your balance, you can borrow again.

Installment credit: (e.g., Auto Loans, Student Loans) you borrow a fixed amount and make regular payments until it’s paid off.

Open Credit: (e.g., Utilities, Charge cards) These are lines of credit where the balance must be paid in full each month. The balance depends on what you use. If you are late, you are charged late fees, and the account is reported to the credit bureaus as late.

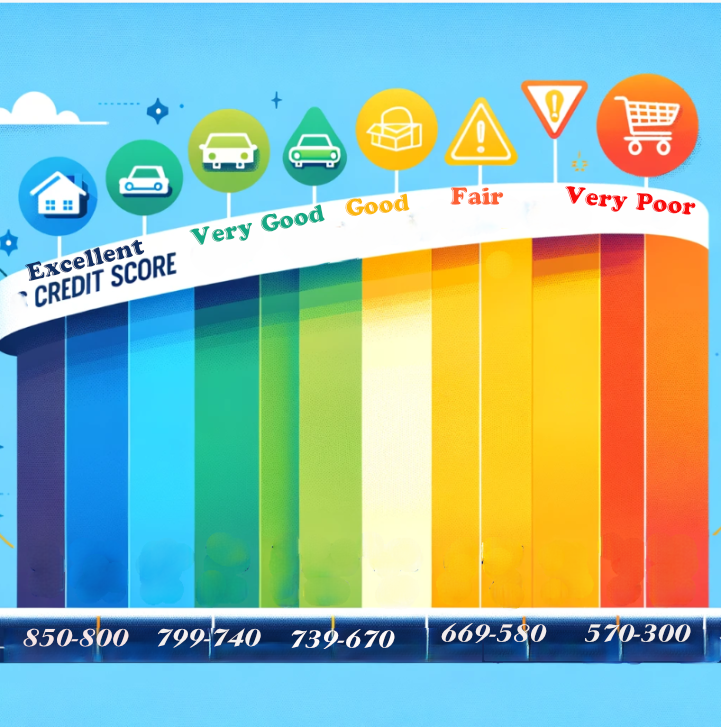

So above you see the credit scoring range. You may notice there are different ranges of scores. Always go by the FICO scoring range because it is the standard for consumer credit. The mortgage industry uses a different FICO scoring model. FICO scores are amazingly accurate in determining risk in individuals paying back what they borrow. That’s what it’s all about “risk”. What’s the risk for lenders? They are giving an individual the ability to make purchases with their money, as long as they pay it back. If they can’t pay it back in full, then there will be interest added to the balance. The lower the score, the greater the risk. Higher interest rates compensate for the increased risk.

Credit scores go up and down all the time. Whenever information is added or deleted from your credit file your score will change. However, your score is not calculated daily. The only time it is calculated is when it is pulled. Whatever is in your file at that time will be scored automatically by the computerized mathematical system. If you made a purchase yesterday and tomorrow your file is going to be updated by the credit bureaus. If you were going to apply for a loan, today would be the primetime to apply. Your credit score is going to be higher today, than it is going to be tomorrow. Because the purchase is going to increase the credit utilization. As it goes up, your score goes down.

If the drop puts you into a lower tier of credit score ranges a monthly payment can be a significant difference.

Influencing Factors in Credit Scoring

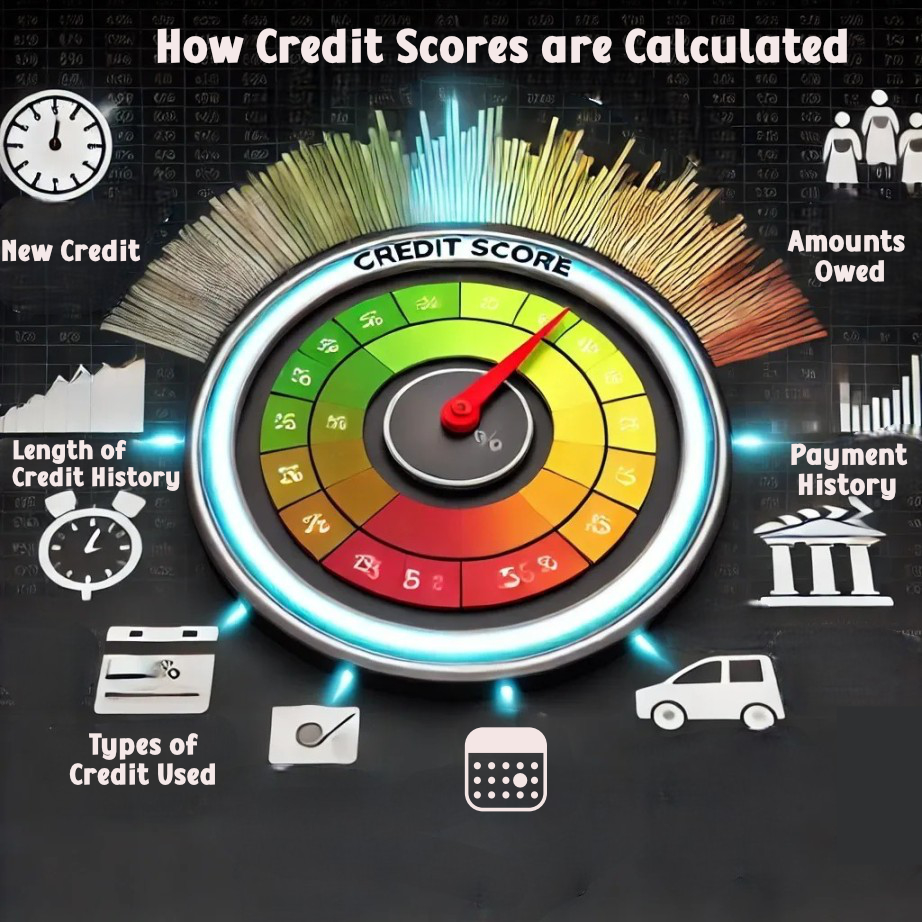

The there are 5 factors that make up your credit score. But within the factors there are 40 components that add or subtract points from your score. Here are the 5 factors that affect your score:

Payment history- The most influential factor. Consistency with on time payments is going to influence a strong credit score.

Debt load- The amount of credit that has been used divided by the credit limit gives you a percentage. As the percentage increases, the less points you earn. At 30% you begin losing points. The higher it goes more points will be deducted.

The length of credit- How long has your account been open. The longer you have an open account that has perfect payment history the stronger it is. When an account is closed, it stops earning longevity points. And you lose the credit limit for the account. This increases your debt load. You do not want to close an account, and you definitely do not want the lender to close the account due to inactivity. Use your credit cards at least twice every three months to keep your account active.

Types of credit- Lenders want to see that an individual can manage different types of credit.

Inquiries- There are two types of Inquiries, soft and hard. Soft Inquiries is when creditors do a check on their customers. This helps to reduce risk for the lenders. If a they see a customer has begun making late payments with their other accounts, the lender assumes their going to be next. They can take action by reducing the credit limit and letting the customer know that the interest rate has increased. A soft inquiry doesn’t hurt your credit score. On the other hand, a hard inquiry is when consumer submits an application for a credit line. Hard inquiries deduct points and will remain on your credit report for 2 years. But they only impact a credit file for the first year.

Additional Information

If you are shopping around for the best home loan, you are going to see more than one lender or mortgage broker. The same goes for auto financing, you want the best terms you can get. For these situations you will have a timeframe to shop around, and the credit pulls will count as one inquiry. However, that doesn’t apply for applications for revolving credit (credit cards). If you apply for multiple credit cards within a short period, a lot of points will be deducted because the risk of taking on more credit that can be handled, increases.

Statistics have shown that someone who has six or more hard inquires in the past year is 8 times more likely to declare bankruptcy than someone that has no hard inquires in the past year.

As you can probably tell, the algorithm that’s used in calculating credit scores is very complex. Forget about your credit score and focus on paying the balance in full, on time every month and keep your balances under 10%. You will have an excellent credit score anytime your credit is pulled.

How to Effectively Dispute an Inaccurate Debt on Your Credit Report

5

If you are at this point, the inaccurate information you want deleted from your file is being validated. You may have received a letter stating: “Unfortunately, we are unable to remove the disputed information reported on your credit report. To preserve the integrity of the credit reporting system, we are unable to alter or remove valid information reported to the credit reporting agencies.”

What is your next move?

Well, you will now send a letter requesting written proof no matter who you are sending your letter to. But there are different letters that depend on who you are sending the letter to.

The terms “debt validation” and “proof of debt” are related but apply in different contexts and have distinct requirements.

Debt Validation

Debt validation applies specifically to debt collectors and is governed by the Fair Debt Collection Practices Act (FDCPA). When a debt collector contacts a consumer about a debt, the consumer has the right to request validation of the debt. The debt collector must provide the following:

- Verification of the Debt: Information about the amount of the debt and the name of the creditor to whom the debt is owed.

- Evidence of Ownership: Proof that the debt collector has the legal right to collect the debt, which typically involves a transfer of the debt from the original creditor to the debt collector.

- Details of the Debt: A statement providing details of the original debt, including the original creditor’s name and the amount owed.

The consumer must request this validation in writing within 30 days of being contacted by the debt collector. The debt collector is required to stop all collection activities until the debt is validated.

Proof of Debt

Proof of debt applies to creditors, the original entities that provided the credit or loan. Creditors must provide evidence that the debt is valid and that they have the right to collect it. This typically includes:

- Original Contract or Agreement: A copy of the original agreement or contract that established the debt, showing the debtor’s signature.

- Account Statements: Detailed statements showing the transactions, charges, payments, and balance history.

- Proof of Ownership: Documentation proving that the creditor owns the debt.

Key Differences

Applicability:

- Debt Validation: Applies to debt collectors who are attempting to collect a debt on behalf of another entity.

- Proof of Debt: Applies to creditors, the original lenders or entities that extended the credit.

Legal Basis:

- Debt Validation: Governed by the FDCPA.

- Proof of Debt: It is not governed by any specific act. However, in order for a creditor to establish the legitimacy of the debt, these documents are what will prove legitimacy.

Content of the Request:

- Debt Validation: Focuses on the legitimacy of the debt collector’s right to collect and the basic details of the debt.

- Proof of Debt: Focuses on the complete details and history of the debt, including the original agreement and detailed account statements.

Summary

- Debt Validation: Ensures that the debt collector has the right to collect the debt and that the details they provide are accurate.

- Proof of Debt: Requires the original creditor to provide comprehensive documentation proving that the debt is valid and detailing the debt’s history.

By understanding these differences, you will be able to navigate your rights and obligations when dealing with debt collectors and creditors. When you request debt validation or proof of debt, they are legally bound by that request and cannot ignore it. If any documents are missing, it is not proper validation. You have the right to send a letter to the credit bureau demanding they delete the information.

The Art of Debt Validation: Unveiling Credit Bureau Secrets

The creditor is not allowed to continue reporting the account to the credit bureaus, they cannot collect any money from you, and they are not allowed to contact you about the debt. With debt validation and proof of debt, you are banking on the fact that the creditor doesn’t have one specific document on hand. The original contract that you signed when you opened the account. Maybe they don’t have the time or inclination to locate your original document that has your signature on it because of the inconvenience.

Medical offices keep excellent records. Some creditors do and some do not. If it is a new account, they probably will have no trouble locating the document. However, if the account is established, paper records may be stored offsite, and locating the document will take time.

If you are in good standing with the creditor, it would make more sense to delete the information and keep their customer, you, happy. However, if you are in bad standing with the creditor, they will ensure they provide proof because you have not upheld your end of the agreement. And they are probably not too happy with the situation.

If it is a debt collector, the older the debt the less likely the debt collector is going to have the original credit agreement. Generally, as debts are transferred or sold, maintaining complete and accurate records can become more challenging.

The chances of a debt collector having a copy of the original credit agreement for the debtor can vary depending on several factors including the age of the debt, the policies of the creditor, and the practices of the debt collection agency. Here are a few considerations:

- Age of Debt: Older debts are less likely to have the original credit agreement readily available. As debts are sold and transferred between different collectors, documentation may be lost or not transferred completely.

- Type of Debt: Certain types of debt, like credit card debt, may not involve a detailed “credit agreement” as one might expect with a mortgage or a car loan. Instead, they might be governed by the terms of service agreed upon when the account was opened, which might be updated periodically.

- Creditor Policies: Some creditors maintain thorough records and transfer these to debt collectors when selling the debt. Others may not keep detailed records or may not transfer all documents to the agency.

- Collection Agency Practices: Some debt collectors maintain comprehensive records and can easily access original agreements, while others may not prioritize keeping detailed files.

- Legal Requirements: Depending on the jurisdiction, there may be legal requirements for debt collectors to retain and provide original credit agreements upon request, particularly if the debtor disputes the debt or requests verification.

How to Challenge Credit Bureaus and Win the Credit Repair Game

You know that credit repair is not a one size fits all. Your situation may have a better outcome by sending letters to creditors. I am going to stick to the general steps. So, we are going to send the next letter to the credit bureaus that show the inaccurate information. We have sent them a letter requesting an investigation be done on the matter. Knowing that they do not investigate, and they do not look over any documentation. You have been keeping track of the letters you have sent. So, you know what date you sent a letter and the date in which they received it.

We expected them to verify the information and send you a response letter back. They are stalling. Trying to deflate your balloon. This tactic works well for them. A lot of people would have quit by now. Who can blame them? It’s frustrating .

They are not expecting you to send a letter back. We want to see what happens when you call B.S. on them.

They should have provided you with the specifics of their investigation. But it was not requested and they are not obligated to.

So let’s request to have their method of verification because you do not believe them. Send this letter certified mail, because they are now obligated to provide you with the specifics. If you do not receive the receipt that shows the letter was signed for, they can say they never received your letter. “It was lost in the mail.”

They now know that they need to provide specific information to you. What determined the information to be valid? What documents were reviewed? You want to know the exact steps they took to verify the information. Who was the investigator? You need their name and contact information so you can communicate with them.

The credit bureaus do not what to give written details of their investigation and hand them over to anyone. It is not like the public doesn’t know. But they cannot lie and write a false report. Stating that they spoke to the furnisher and had them pull out their records and reviewed documents. They can’t do that. That would be a lie and in writing.

And they also do not want to write what actually occurred and hand it over to a consumer. But they are required to because you requested it. They do not want to tell you that they outsourced the dispute to the Philippines, nor do they want you calling their agent and the agent saying something they are not supposed to. In fact, the vendor’s do not have phones at their workstations with the disputes that are outsourced.

Their other option is to delete the information altogether, and the problem goes away.

Sample of Method of Verification

Sample Letter for Incomplete Debt Validation

Disputing Negative Items on Your Credit Report

4

Understanding the Impact of Closed Accounts on Your Credit Score

On your credit report, you will find both open and closed accounts. Closed accounts can affect your credit score in several ways. Here’s how:

When an account is closed, the credit limit on that account is deducted from your total available credit. This increases your credit utilization ratio, which is the percentage of the amount of credit that you’re using from what is available to use.

For example, if you have three credit cards. Each has a limit of $4,000. The total available credit is $12,000. If you have used $4,000 of the $12,000, your credit utilization is 33%.

If one card with a $4,000 limit is closed, your total available credit drops to $8,000. Your credit utilization jumps to 50%, which will negatively impact your credit score. Experts recommend keeping your credit utilization under 10%. Because you gain points when your score is calculated. 30% is the point when your score will start losing points and the higher the percentage goes, the more point you lose points.

In addition to your credit cards being scored altogether, they are also scored individually. The balance that will earn the most points is $0. However, if there is a $0 on a closed account, it will negatively impact your credit. Closed accounts that read “paid as agreed” is how the status on a closed account should read.

How Credit Utilization and Account Longevity Influence your Credit Score

When an account closes, in addition to credit utilization, the average length of a consumer’s credit history shortens. The length of credit history is a significant factor in determining your credit score. It contributes 15% to your overall FICO credit score. Here’s a breakdown of how this aspect is evaluated:

- Age of Accounts: Credit scoring models consider the age of your oldest credit account, the age of your newest credit account, and the average age of all your accounts. A longer credit history with great payment history generally indicates more experience managing credit, which positively impacts your score.

- Length of Time Accounts Have Been Open: The longer your accounts have been open and in good standing, the better. It shows a history of responsible credit use.

- Time Since Recent Account Activity: Credit scoring models also consider how long it has been since you used each of your accounts. Regular, responsible use of credit is viewed favorably.

The length of credit history accounts for 15% and credit utilization accounts for 30%. These two factors make up almost half of your credit score.

Implications of a Closed Account

A lender will look at a consumer’s credit score to help determine if the applicant is a high risk. In addition, to looking at a credit score, lenders will review a consumer’s credit report. Within your credit report there is information that are red flags for lenders. As an example, if a credit report states that the consumer is working with a credit counseling service or a debt management company. It tells potential lenders that the consumer cannot manage their money. Lenders see this as bad as Chapter 13 bankruptcy.

An account can be closed by the consumer or by the creditor. If your account is closed, you want to be the one who closes the account. A creditor closing an account does not look good to potential lenders. It is a red flag, lenders might interpret that the creditor closed the account due to the consumer’s financial instability or inability to manage credit responsibly. I

To avoid having an account closed due to inactivity, you only need to use your credit card twice every 3 months to keep it active. And the purchase doesn’t need to be expensive. It could be as small as a pack of gum.

A closed account stops earning longevity points, that is what you want, longevity with excellent payment history. That builds strong credit. And you get more points for maintaining a credit account for a long time. However, if a closed account is in good standing with the creditor. It will still be beneficial because it shows a record of timely payments. Your credit payment history accounts for 35% of your credit score. It’s the most influential factor.

It will also help with the age of accounts because remember the scoring model considers the age of the newest account, the age of the oldest account is, and the average age of all your accounts is also considered. Closed accounts will contribute to that factor.

A closed account in good standing reflects well on your ability to manage credit responsibly. Future lenders view this positively as it indicates that you have a history of honoring your credit obligations, even if the account is no longer active.

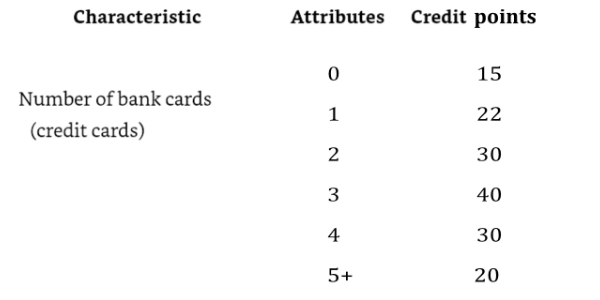

When to Consider Closing an Account

While it’s generally advisable to keep credit accounts open, there are situations where closing an account might be beneficial. As an example, if you have an excessive number of credit cards (e.g., 10), closing a few may be a good idea to maintain a manageable amount of credit. A potential lender doesn’t know how you’ll be able to handle a new line of credit. Everyone has that point where it’s too overwhelming. Having too much credit is not a good thing for potential lenders to see. Three credit cards earns the most points; having more will negatively impact your score. This is just one of many characteristics that determines your credit score.

How to Close a Credit Account Properly:

- Pay Off the Balance: Ensure that the account balance is paid as agreed.

- Notify the Creditor: Contact the creditor to request the account closure.

- Confirm Closure: Obtain a written confirmation that the account has been closed.

- Monitor Your Credit Report: Check your credit report to ensure the account is marked as “closed by consumer” if you initiated the closure.

Handling Negative Items on Closed Accounts

If you have a closed account that is paid off but have negative items, such as a balance showing that you already paid off and late payments. This account is hurting your score and will look bad when a potential lender reads your credit report. This type of account needs to go.

But you never want to write that the balance is wrong. What do you want to write? “The account is reporting false information.” Whatever the issue is, reference it as “an account that is reporting false information”. In which case you have the right to demand deletion.

That is a true statement that is based on the law. Don’t write about your struggles. Don’t send a goodwill letter and risk the chance of saying too much and admitting the account to be yours.

Your dispute letter is not disputing the account or negative item as being yours because that could be a lie. Your letter is disputing the fact that false information was reported and posted on your report. You see any information that is added to a consumer’s credit file must be verified as accurate.

In other words, if I open up a credit line. The creditor is going to report the account to the credit bureau. When the credit bureau receives notice of a new account. They must verify that the consumer did indeed open up a new account. Before it is added to their file.

The law doesn’t say that derogatory accounts must remain on your credit report for a period of 7 years. It only limits the amount of time they can be visible on your credit report. So, removing derogatory accounts is 100% legal.

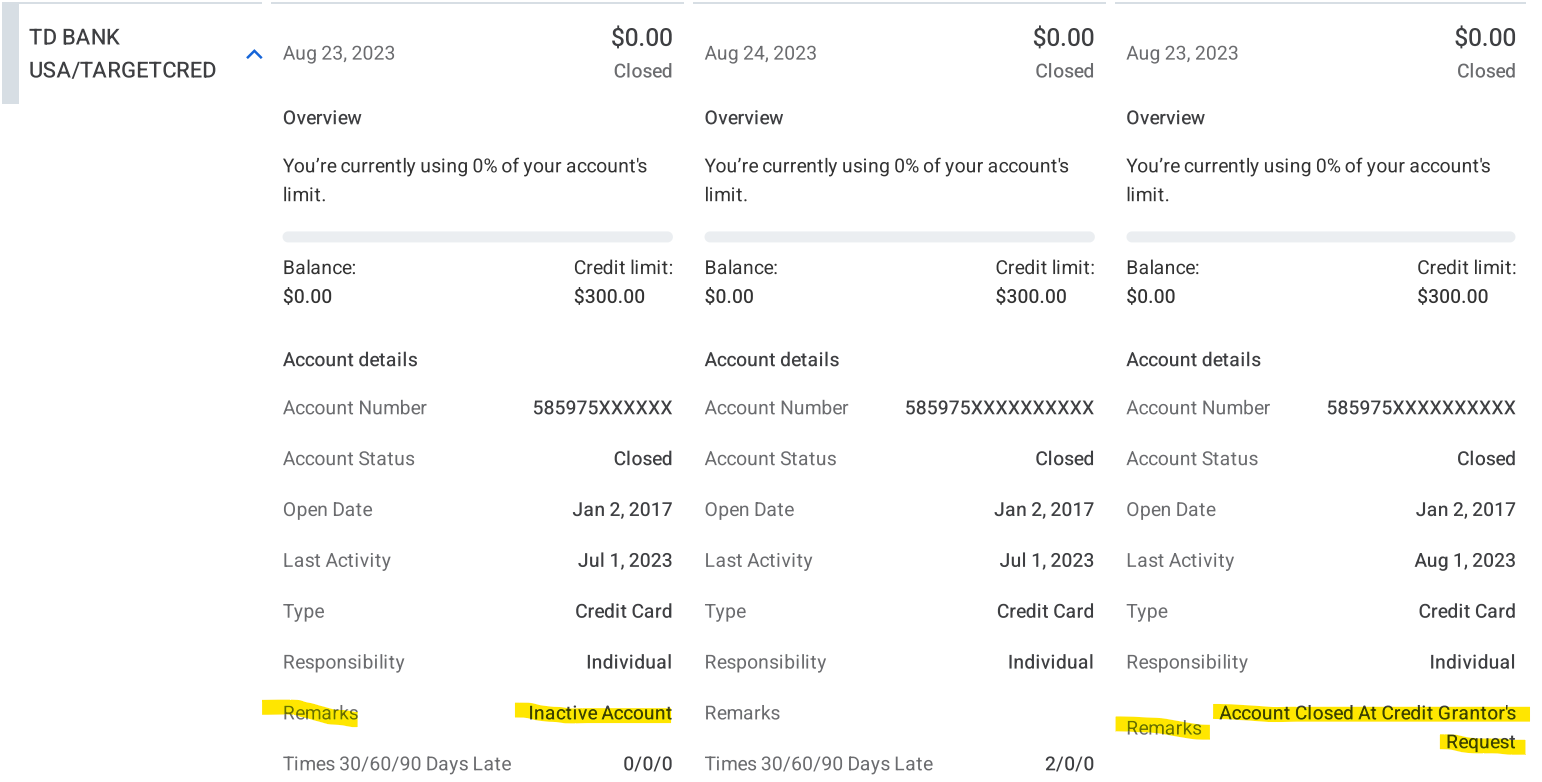

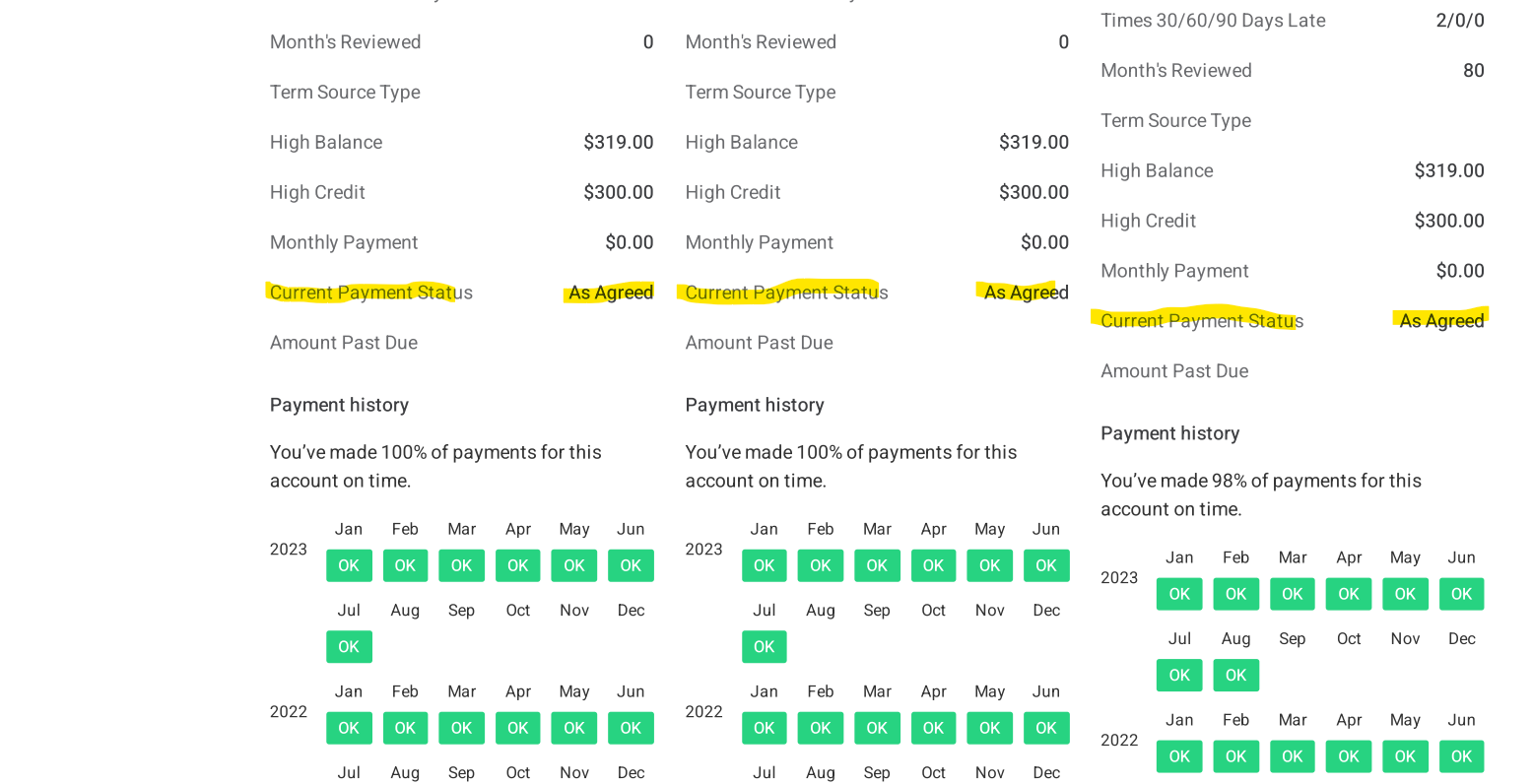

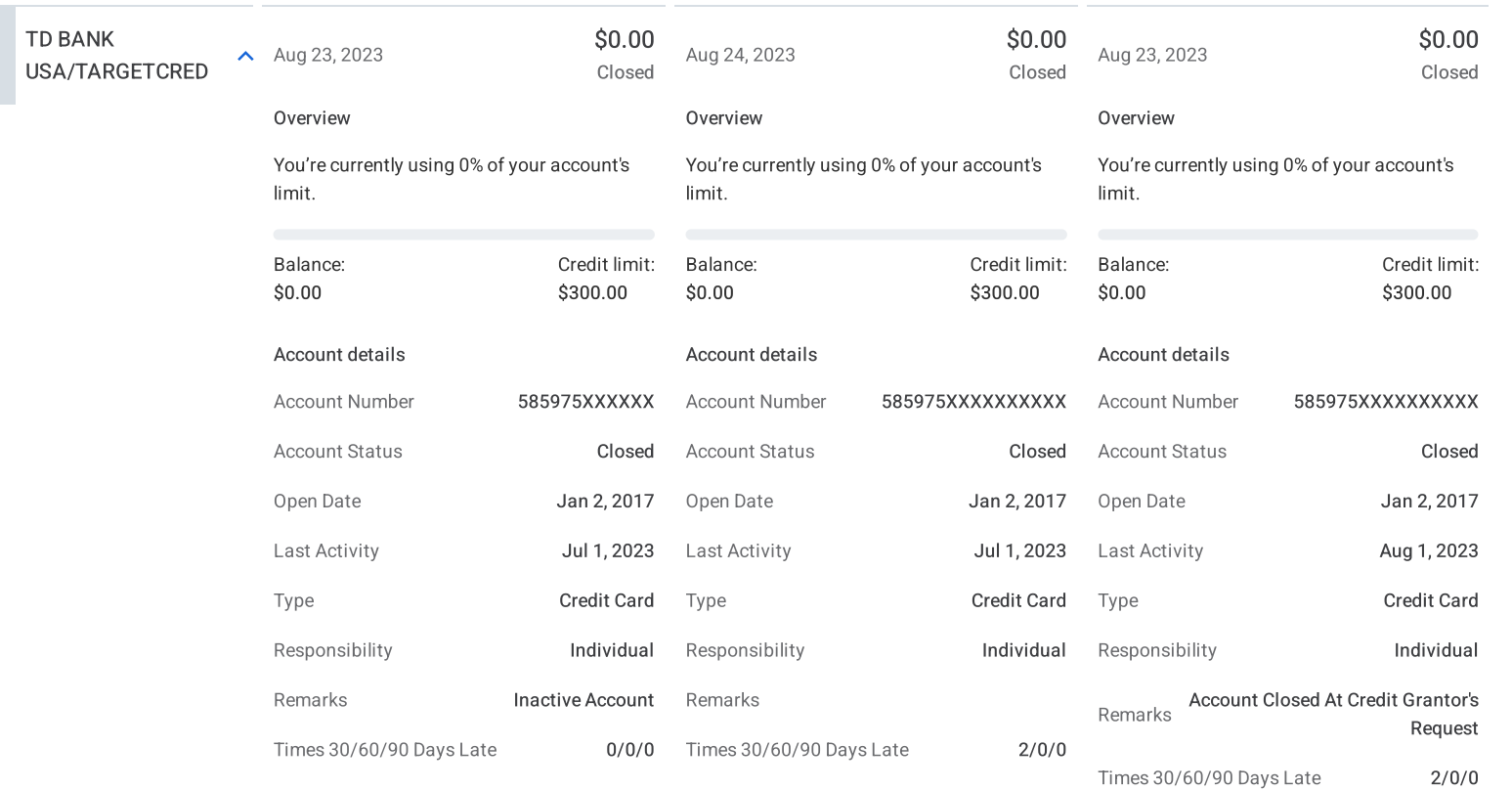

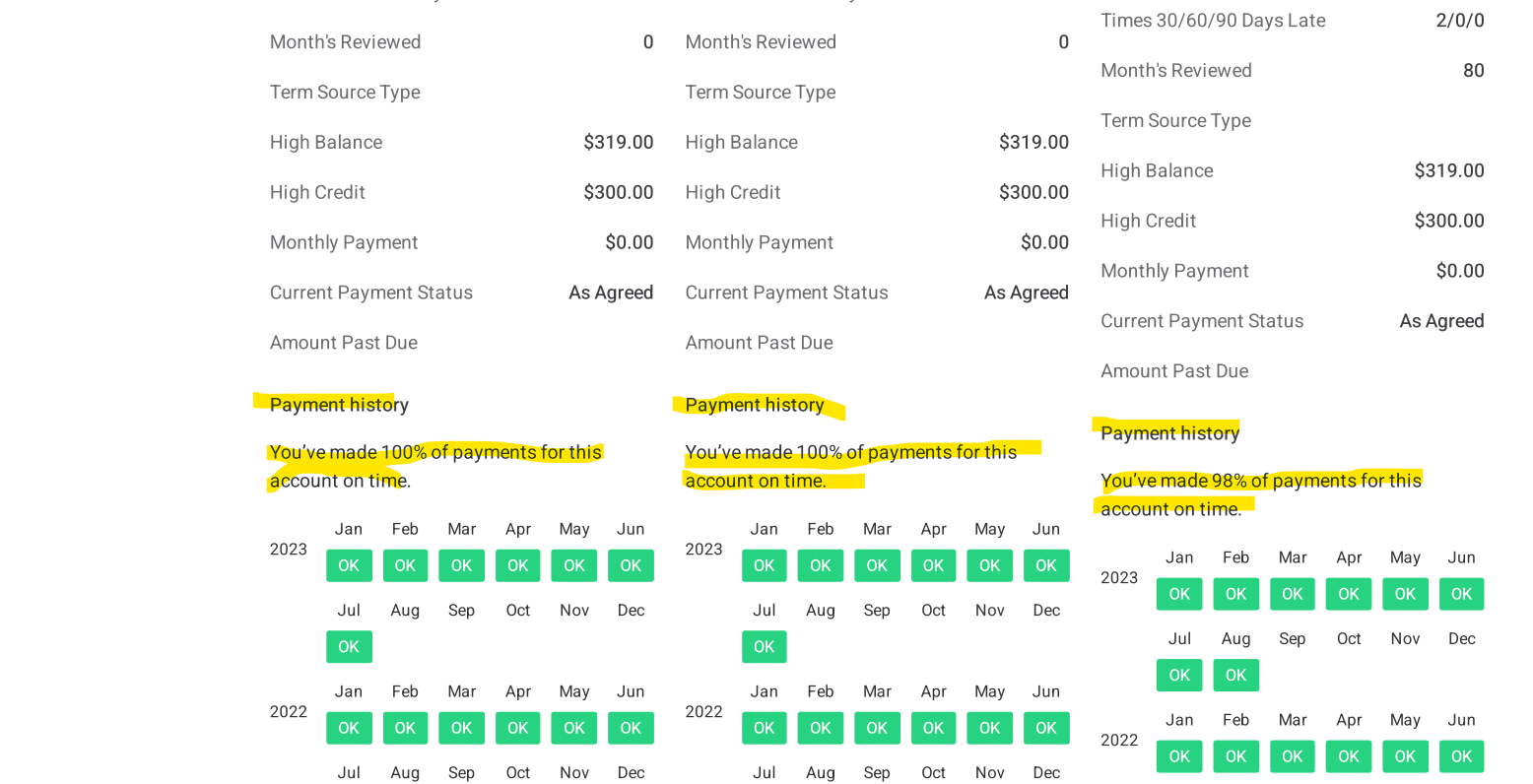

Take a look at this Target account from my reports. There are 3 columns, each one represents a different credit bureau. The account is paid off and closed. You can see that this account has 2 late payments that occurred in 2018. They hurt my score whenever it is calculated. Also, the account was closed by the creditor. Remember that is not good for potential lenders to see.

The payment status is “as agreed”. That is what you want the payment status on closed accounts to read. The payment history is almost perfect. That will help when my score is calculated. Because of the payment history, I want to keep this account listed.

If I was going to have this account deleted, I would send the letter to the credit bureau first. The rule of thumb is to challenge the credit bureaus first and creditors second.

Remember the previous step we sent the letter to the credit bureau. Assuming we received a verification letter. We would send a letter to the creditor next because they reported the information. They will need to prove it or delete it. Those are the only choices they have.

You want your letter to depict you as an honest person who is astonished to find an error on your credit report. And because the law allows you to exercise your rights and demand an account with false information posted, be deleted. That is what the letter is instructing them to do. Because your credit is very important to you and don’t want your credit to be negatively impacted. Versus someone who hired a service to remove a list of derogatory items.

letter to creditor to remove negative item from report

Identifying and Correcting Errors in Your Credit Report

Is there anything wrong with the account, maybe there’s a zero that should be the letter O. Maybe the date is wrong. A common error is a balance showing on a paid off account. When the creditor sells an account, they don’t own the account and cannot collect money on the account anymore. The balance should show $0.

The Target account shows $0 for the balance. The fact is I will keep the Target account because the payment history will help my credit score.

But I will use it as an example. If I wanted to have it deleted because of the two 30-days late payments, I would look for a factual error.

You want to look for any false information. In a previous step you had chosen a form of your legal name you were going to use going forward. Any other names listed on your credit report; you had them deleted.

Check to see what name is tied to the account with the negative item. If the name tied to the account is not your chosen name, the information on the account is false. You can demand deletion of the account.

You also had addresses removed. What address is the account tied to. If it is tied to an address that was deleted, the information is is now false.

When reviewing your three credit reports, it is important to directly compare them side by side to ensure that they are accurate and consistent. Discrepancies may occur during this examination. Let’s use the target account as an example.

Again, each column is a different credit bureau. The creditor is Target, same account, same creditor. The credit bureaus will not know anything that isn’t reported to them. Because of this, I can understand if Experian didn’t show my Target account on their report. I can make the assumption that the creditor reports only to Equifax and TransUnion.

However, if the creditor is reporting to all three credit bureaus, as Target does, I expect the information to be the same across the board. If Target reported to TransUnion and Equifax that; “I had made 100% of payments for this account on time”. What should I expect Target to report to Experian? I expect to see the same post, right?

Experian shows that Target reported that; “I had made 98% of payments for this account on time”. This my friend is inconsistent reporting. This leads to discrepancies in my credit reports, which is going to affect my credit score and lending decisions. Since it is the same account only one of the two different statements can be true. If I didn’t compare the three reports side by side, I never would have caught this error.

Credit repair is not a straight line. You may need to adjust to make sense for your situation. For example, in this step we are sending a letter to the creditor. But for this discrepancy, I would send a letter to the credit bureaus before I send a letter to the creditor. Because the creditor could make the correction needed and then tell the credit bureaus to make the change in their records.

When I provide screenshot copies of the account from my report and point out that contradictory statements have been reported and posted to my file. I demand the account be deleted. There isn’t any proof that can be provided that will make the contradictory statements true at the same time. I am sure that there is a simple explanation why this error occurred.

But that isn’t the issue anymore, the problem is that the report is misleading for potential lenders. The quick and easy option is to delete the account. And the creditor won’t have to be bothered with this error.

It’s a closed, paid off account. It does not hurt the creditor at all if the credit bureaus delete to the account. Whereas this does hurt my credit by having it remain.

In reality, the payment history on the account outweighs the two 30-days late payments. So, I am going to leave this account as is.

You will have twists and turns that don’t follow the fundamental steps of the disputing process. A step might be sending the letter the furnisher, but a situation may have a better chance of success if the letter is sent to the credit bureau.

Back to the step, in the letter I would include screenshots from the three reports that show the contradictory statements, printed out so I can place into the envelope before sealing it. Pointing out the inconsistent reporting in the letter and demand deletion of the account reporting false information.

By this time the letter has been sent and received by the creditor. Generally, the creditor has the proof of verification somewhere in their records. The question is, does the creditor have the time to search their records for verification? Time is money for them. They may not have the time to go searching, or it might be too much of a hassle for them. Deleting the information will be less of an inconvenience.

Now your credit history with the creditor will come into play. If you have a great history, it would be better to keep you happy and delete the information. That could result in you applying and opening a new account, using credit, and the creditor makes money in the long run.

If you have multiple late payments on the account, expect the creditor to dig through their records and find the proof. Your next move is to wait for a response to your letter.

Letter for Closed Paid Off Account

Handling Late Payments on An Open Account

Make sure you are not behind on any credit card or loan payments before attempting to remove late payments from an active account. Prioritize catching up on any outstanding payments and maintaining a regular schedule of paying on time. This step is essential as it becomes challenging to dispute past late payments if you continue to be late in your current payments.

Compare all three reports against each other and check for any discrepancies within the three reports, like I did above, before you send any letters.

If you have one late payment that is older than two years, and the rest of your credit is perfect, you could leave it alone. Because it isn’t hurting your score as it did the first two years. The longer it has been since the negative event occurred, the less and less damage it will do.

But if you want it gone, if you have proof to show you weren’t late, get it. I know the burden of proof is on the creditor, but honestly the burden of proof is on both parties. The proof can be the bank statement showing the funds being withdrawn.

If you lack evidence and have a single late payment with an otherwise flawless report. It is out of character for you. Your report indicates that this late payment is an anomaly. You do not typically have a track record of late payments.

The obstacle you face is the one who reads your letter. What if the representative is the type that dictates the law to borrowers? The law says that inaccurate data cannot be added to a consumer’s file. And accurate data cannot be deleted. Therefore, the information on file must be accurate.

To ensure your letter reaches the appropriate person, consider identifying the individual responsible for handling customer complaints.

- You can locate this information on the company’s website,

- Conduct a Google search using the company name + “file a complaint,”

- Or contact their customer service hotline for assistance.

Once you find the name, address the letter to that specific individual, ensuring you spell their name correctly. Avoid using generic salutations like “Dear Sir or Madam.” If the name is unavailable, you can opt for “Dear Executive.” If your handwriting is clear, consider writing the letter by hand.

The letter you send should be non-threatening and complimentary, expressing appreciation for their service. As a loyal customer, you anticipate continuing to support their business. As you conclude the letter, make it clear to the recipient that your business dealings with them are paused until the inaccurate information is deleted.

Again, your credit history will come into play. If you’re a long-time customer with a good history, it makes more sense to delete the late payment to keep a loyal customer and the creditor is able to keep your credit line open for use, everyone wins.

Unfortunately, I cannot guarantee this outcome. If you are denied, that’s fine, move onto the next step. If the creditor is Capitol One, challenge the late payment with the credit bureaus instead. Because Capitol one will not delete a late payment.

Multiple Late Payments And Covid

If you experienced late payments during the pandemic due to illness or job impact, the CARES Act might have prevented these from being reported. A legal clause could be applicable in this context. Below is a sample letter for such circumstances.

This letter will be directed to the credit bureaus responsible for listing the late payments on your report. It is advisable to send this letter via certified mail to obtain a receipt upon their acknowledgment of receiving and signing for it. The bureaus are required to furnish you with proof within 45 days. Once they acknowledge receipt by signing for it, they are legally bound to address it and cannot claim they did not receive it. Keeping the receipt of their signature handy will be beneficial if needed.

Tips for deleting late payments

- When addressing multiple late payments: Dispute one account at a time per credit bureau if you have late payments on several accounts.

- Maintain professionalism and politeness: Ensure your letters are professional and courteous.

- Use friendly language: End your letter with a warm closing like “Thank you in advance” and start with a friendly greeting such as “I hope you are well.

- Providing documentation to credit bureaus: Update your personal information and include three to five identification documents displaying your correct name and address to improve the chances of deletion. It’s been proven by credit repair businesses that including several pieces of ID helps obtain the deletion.

- Organize your correspondence: Create a system, like a dedicated folder on your computer, to store all your communications, relevant documents, and screenshot images in one place.

A Comprehensive Guide to Disputing Derogatory Items with Credit Bureaus

Introduction

Remember this word Frivolous, it means nonsense. If the credit bureaus can determine a dispute is frivolous, they are not required to do anything. That’s their focus because they are just businesses trying to make a profit like any other business. Businesses try to reduce their expenses for many reasons. One of those reasons is to increase the profit margin.

Consumers are not the credit bureaus’ customers. We do not pay their bills. The “furnishers” do. They are the credit bureaus’, main concern. They bring in more revenue for them than any other areas of their business. Furnishers are the banks, lenders, and creditors. The only concern towards consumers is how can they reduce the cost of investigations.

The Reality of Credit Bureaus

Unless you are wealthy, consumers cannot avoid having a credit history. And we have no say in whether our information is included in the credit bureaus’ databases. We cannot take our information and go somewhere else with it.

Whereas the furnisher can switch between the credit bureaus if they want. Reporting to the credit bureaus cost creditors money. Equifax does not want to lose a creditor to TransUnion. Which can happen if a credit bureau conducts thorough investigations.

The credit bureaus blame credit repair businesses as the reason for their careless investigations. They say that credit repair companies generate frivolous disputes. The make promises of removing valid negative information from consumers reports. About 30% of credit disputes involve credit repair businesses, but they assume every dispute is like this, trying to remove valid negative information.

They know very well you can’t assume every dispute involves a credit repair business. And they do not all try to remove valid negative information. But that still doesn’t explain why they conduct meaningless investigations. It might be a fraction of the reason why, but the real reason is because they are too expensive and undermine their paying customers efforts to collect money from borrowers

Credit bureaus don’t prioritize consumers because credit disputes are a business expense. They are spending money on people who are not their customers.

Conducting real investigations could harm furnishers efforts to collect debts from people. In other words, investigating disputes could reveal that some debts are incorrect or unfair, making it harder for them to collect those debts.

Careless investigations reduce the cost burden of investigations. And they don’t ruin the chances of furnishers collecting their money. They are going to keep their paying customers happy rather that help the consumer. Whatever the furnisher’s say goes.

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act was passed in 1970 to address several issues related to consumer credit information. One of the issues being accuracy. It’s supposed to promote the accuracy, fairness, and privacy of consumer information contained in the files of credit bureaus.

The Fair Credit Reporting Act was passed in 1970 to address several issues related to consumer credit information. One of the issues being accuracy. It’s supposed to promote the accuracy, fairness, and privacy of consumer information contained in the files of credit bureaus.

Here are reasons an account can be deleted:

- Incorrectly reporting an account that does not belong to you.

- Incorrectly reporting a late payment.

- Inaccurate reporting of the account date.

- Reporting an outdated negative account.

- Incomplete reporting due to missing information.

- Reporting information that cannot be verified.

Important Facts – 54 Years Later:

- 79% of credit reports contain errors.

- 54% include personal information that is incorrect.

- 22% of reports have loans that were listed twice.

- 8% of reports were missing positive credit information that boosts credit scores.

6 million Americans have errors on their credit reports. Not everyone is disputing errors. I would make a bet that majority of them don’t even know that there is an error. Let’s say only 3 million requested disputes. That is a lot of money. Let’s say half of that resulted in valid errors and needed to be deleted. Thats a lot of money furnishers are not going to be able to collect. This may seem hopeless, but this information can be used to your advantage. You now know that they do not conduct a thorough investigation. That information is going to come in handy later on.

Understanding the Law

Let’s talk about the t law. Credit reports must be 100% accurate. Accurate information cannot be removed from a consumer’s file. People are not perfect, and the credit bureaus employ a lot of people. Of course, errors are going to happen now and again, that’s understandable. The FCRA allows consumers a way to fix the errors that have been made. One thing to remember is that a consumer must exercise their rights. It’s the only way to hold the credit bureaus accountable.

Let’s talk about the t law. Credit reports must be 100% accurate. Accurate information cannot be removed from a consumer’s file. People are not perfect, and the credit bureaus employ a lot of people. Of course, errors are going to happen now and again, that’s understandable. The FCRA allows consumers a way to fix the errors that have been made. One thing to remember is that a consumer must exercise their rights. It’s the only way to hold the credit bureaus accountable.

The FCRA says the credit bureaus are required by law to investigate consumer disputes submitted in writing within 30 days plus mail time. The FCRA has not been updated to include telephone or online disputing. Assume that you lose your rights if you dispute any other way than USPS mail. Disputing by phone or online puts you in harm’s way in terms of your dispute being labeled as frivolous.

Ignoring a valid dispute letter is a violation for the credit bureaus. But if the credit bureaus determine your dispute to be frivolous or nonsense, they are not required to investigate.

What Makes a Dispute Frivolous?

- You want your letter to be clear and easy to understand.

- You want to write it in a genuine and honest way.

- You want your letter to sound believable.

- You want it to be based on facts that can be verified.

- You want it to be honest and accurate.

- You want it to be legally strong and valid.

The E-OSCAR System

In every business a common goal is efficiency. Which is streamlining operations to reduce cost and increase productivity.

In every business a common goal is efficiency. Which is streamlining operations to reduce cost and increase productivity.

In 1993, efficiency was rolling out E-OSCAR (Electronic Online Solution for Complete and Accurate Reporting). It was developed and implemented by the credit bureaus so that they can eliminate disputes as fast as possible. When you use online disputing, it’s completely automated. The only difference between online disputing and using U.S. mail is live employees reads the letters.

Both creditors and credit bureaus like the current system because it lets them spend only a few seconds on a dispute instead of taking the time needed to properly resolve it. Employees and vendors must meet quotas. No one is focused on getting to the bottom of the dispute. The investigator should be focused on the facts with an unbiased opinion. Here is a nasty secret, the credit bureaus do not investigate. They receive information and even though they are required to validate any information that they add to any file, in reality, the amount of information that is processed each month would bring would destroy any efficiency they have.

What Happens During an Investigation

Are you thinking, reviewing documents, researching facts, interviewing witnesses, or comparing handwriting? Calling the consumer to talk to about the issue and get their side of the dispute. Well, then wait until you read what goes on.

The Investigation Process

There’s no incentive for conducting a true investigation. The role of the credit bureau employees assigned to credit reporting disputes have very restricted duties and responsibilities. The credit bureau employee will receive the dispute letter and read it, as well as review any supporting documentation. They will get a sense of the dispute.

There’s no incentive for conducting a true investigation. The role of the credit bureau employees assigned to credit reporting disputes have very restricted duties and responsibilities. The credit bureau employee will receive the dispute letter and read it, as well as review any supporting documentation. They will get a sense of the dispute.

The credit reporting industry uses a standardized electronic form: Consumer Dispute Verification form. It has a few items on it. Identifying information about the consumer in the credit bureau’s file; Place to enter a dispute code; Place for comments. Enough space for a 1-2 sentence of commentary.

The employee has 26 dispute codes to choose from. They are choosing the dispute code that best matches what they just read in the consumers letter; Of the 26 dispute codes, 5 of them are used for the vast majority of disputes.

- Not his/hers

- Disputes present/previous Account Status/History

- Claims Inaccurate Information. Did not provide specific dispute

- Disputes amounts

- Claims account closed by consumer

Let me resay that. The consumer’s detailed letters are summarized into a 2-to-3-digit code. No attachments can be sent electronically. The employee sends the electronic form to the furnisher. That officially initiates the investigation.

The dispute system is dependent on the dispute codes. When the furnisher receives the dispute form, the furnisher knows it means to investigate. Do you really think that the creditor is really going back into their records to prove the information is verified as being accurate? After they see the dispute code. What are they even supposed to investigate if they only have the electronic form to work off of?

The majority of disputes end with the furnisher verifying the presence of the disputed information without investigating the dispute itself. They don’t examine the details, review documents, or speak with consumers regarding the dispute. Instead, the furnishers just check that the information on the Automated Credit Dispute Verification form matches their own computer records, and then confirm the disputed information to the credit bureaus is verified as accurate.

And then the verified letter is sent to the consumer. Stating that the disputed item has been verified as accurate. And because the removal or deletion of accurate information is against the law. The information will remain.

All of a sudden, the law is brought up. Where was the law during the process? What is anybody going to do about it anyway? Who is going to know?

Well, now you know, and you can work with it. It’s not going to get better. Two reasons why consumer disputes outcomes will not be fair:

- Consumer disputes are a business expense to the bureaus and to increase the business profit margin they must reduce business expenses.

- Conducting a reasonable investigation has the potential to of hurting their customer’s business of collecting debts from borrowers.

What can anyone do?

Well, use this information to work for you. The credit bureaus do not have free reign. They have a lot of room to maneuver, but when the consumer exercises their rights, they have to follow the law. They cannot say that the information is verified and leave it at that. If they allegedly did what they say they did, then they can prove it.

Be prepared to send multiple dispute letters because in credit repair, sometimes you hit a point where nothing works. And the credit bureaus try to stall by sending the same response letter, hoping that consumer will give up and move on.

The response letters do not include any specifics about the investigation that took place. Probably because they don’t want the consumer to know what went on. They are only required by law to provide details when the consumer requests it.

I am jumping the gun on the process, we are not there yet. We are discussing the first round right now. This letter is just a request for investigation. But during the process you will have your chance to demand details of the investigation.

Some Tips to Help Along the Way

- If you have receipts or billing and payoff statements to support your dispute, include them with your letter.

- Avoid explaining too much in the letter itself. Sympathy is not part of the credit bureaus vocabulary. Explanations only admit to the error being true and accurate. Let supporting documentation do the explaining.

- Credit repair letter templates will quote the law code. Regular, everyday consumers do not. If the credit bureaus get a hint of a credit repair business letter, they will label the dispute frivolous and ignore it. The credit bureaus ignore letters they believe are generic, that have been found on the internet.

- Only one negative item per dispute letter. Dispute letters with lists of negative items to dispute do not come off as someone who is surprised to see an error on their report. It’s more like something a credit repair business would do for their client.

- Handwritten letters are preferred, but if your handwriting is hard to read, print out your letter instead. Avoid using cursive writing. You want your letter to be easy for the reader to understand.

- Envelopes will be thrown away. Always include your name and address in your letter.

- If necessary, add a note at the top like “Time Urgent!”

- When closing your letter, use a different closing like “Best wishes” instead of “Sincerely.” This helps avoid sounding like a generic template.

- Send your dispute letters via USPS mail, even if the credit bureau responds to you by email. They will likely use email to save on postage costs, so be sure to check your email for their responses.

- If cost is an issue, consider using certified mail only for items that are very important and for which you have a strong case for deletion. There’s no need to request your free annual credit report by certified mail.

- If you send your letter with tracking, write the tracking number at the bottom of the letter before sealing it. This shows that you are keeping an eye on the timeline and expecting a prompt response.

- It’s very important to keep track of which letter you sent, who you sent it to, and when you sent it. You can keep this information on your computer or write it down in a notebook. You can even take photos of the letters and envelopes with your phone. Hopefully, you won’t need these records, but if you do, they’ll help you prove your case. It’s better to have them and not need them then it is to need them and not have them.

- Sign your letters by hand because credit repair companies do not use handwritten signatures.

- About 30% of credit reports have open accounts listed that have actually been closed and paid off. This can be beneficial if the account was paid as agreed because it helps your credit rating. However, if the closed account has late payments, it will hurt your credit score.

For example, if you have an account has multiple late payments. That shows a balance of $866, but you already paid it off. You should aim to have this account deleted to improve your credit score. If you write, “This account is an error, I paid that account off already, please delete it,” the credit bureaus will just update the balance to $0. Because saying that “you paid it off already”, is admitting that the account is yours.

Changing the balance to $0 makes the information accurate and true. It will then be impossible to delete. The late payments will continue to affect your credit score until they age off the report.

Instead, simply state, “This account is providing false information. Please delete it.” This approach doesn’t admit anything and is more likely to result in the account being deleted.

Be polite and present yourself as a responsible consumer who values their credit rating. After reviewing your credit report, you found an error and want it corrected.

I think we covered it all, so you can move on to the next step.

Sample Letter for requesting an investigation

Mastering Credit Management: Essentials to Maximize Your Credit Score

3

Handling credit matters might initially appear overwhelming, but grasping the core principles can equip you with the ability to cultivate a strong financial standing. This comprehensive guide will walk you through interpreting your credit reports, rectifying any inaccuracies, and strategically boosting your credit score. Let’s commence by revisiting the basics.

Step 1: Obtain Your Credit Reports

Obtain copies of your credit reports from the three primary credit bureaus. This foundational measure is pivotal for gaining insights into your present credit situation and pinpointing any erroneous information that could be adversely influencing your financial well-being.

Step 2: Opt Out of Unsolicited Credit Offers

Safeguard your personal information and mitigate the risk of identity theft by choosing to opt out of receiving unsolicited credit card offers and loan solicitations. Furthermore, implement a credit freeze on your reports to prohibit unauthorized parties from accessing and manipulating your financial records. Any inaccuracies or inconsistencies found within these reports can have a detrimental impact on your credit score.

Step 3: Thoroughly Review Your Credit Reports

Carefully review each section of your credit reports for accuracy. Make sure they are 100% accurate and complete. Credit reports can be intimidating at first. Each one will contain the same information that includes:

- Personal Information: Your name, address, Social Security number, date of birth.

- Credit Accounts: Details of your credit accounts including banks, credit card issuers, and other lenders. This includes the type of account (mortgage, auto loan, credit card), the date you opened the account, your credit limit or loan amount, account balance, and your payment history.

- Credit Inquiries: A list of entities that have requested your credit report, such as lenders when you apply for a loan or credit card.

- Public Records: Bankruptcies, foreclosures, lawsuits, wage attachments, liens, and judgments.

- Collections: Past due accounts that have been turned over to a collection agency

Although the presentation of the information may vary, the core data remains consistent across credit reports. However, it’s important to note that not all creditors report to all three major credit bureaus. You might have a creditor that exclusively reports to Equifax, for instance. In such cases, the other two bureaus, TransUnion and Experian, would be unaware of that particular account since they have not received any information regarding it.

Creditors do not necessarily update information simultaneously. Typically, they report data around the time when your billing cycle is due, which is approximately every 30 days. The credit bureaus, on their end, will incorporate these updates anywhere from the same day to up to a week later. This discrepancy in reporting timelines is the reason why you may find one of your accounts listed on only one of your credit reports, and consequently, your credit scores may vary across the different bureaus.

Do not worry about your credit score. Technically you don’t have a credit score until your file is pulled and then it is calculated. It’s not saved, and you can’t use a previous score. Credit files change frequently. As information comes in from different sources, files are updated. Any information that is added to your file is going to impact your credit score.

There are too many factors that go into the calculation of credit scores. Your credit score is based on the information in your credit file. If your reports look good, your score will be good.

Your initial focus for review and rectification should be your personal details. This step establishes the foundation before initiating any disputes for successful credit repair. The personal identifiers to verify include:

- Your full name

- Residential address

- Date of birth

- Social Security number

- Phone number

Ensuring the accuracy of these core identifiers is crucial before proceeding with further actions.

Consistent Personal Information

Name: Regarding your name on your credit report, the objective is to have a single, consistent form listed. Or, at the very least, minimize the number of name variations present. If both your maiden name and married name appear, that is understandable, resulting in two forms being listed.

Hyphenated last names can potentially lead to confusion. Data entry errors could occur, causing inaccuracies. For instance, if I applied for a credit card using “Tom” instead of “Thomas,” but the creditor inadvertently entered “Tim” into their system, then “Tim” would be reflected on my credit report. Errors in your name and an excessive number of name variations can create issues. However, no one will proactively notify you about such errors. It is the individual’s responsibility to ensure that their credit report is 100% accurate.

Merged or mixed credit accounts are a prevalent issue, but they pose a significant problem. This error can lead to the denial of credit lines. Additionally, if the mixed account contains derogatory information, it could cost you potential job opportunities. Surnames are particularly susceptible to identity issues, errors, and merged credit files.

One of the primary reasons for minimizing name variations is to demonstrate stability. Stable individuals are less likely to default on their financial obligations.

Removing extra names from your credit reports will not only increase your score but also separate your file from those with similar names.

When eliminating names from your credit report, it’s crucial to retain accounts associated with positive credit history.

Let’s revisit the example where a creditor incorrectly entered my name as “Tim” in their system instead of “Tom.” Since no one was verifying for errors, the name on file became “Tim Smith.” However, the payment history on this account is perfect, making it an account I want to retain.

The problem arises when a lender notices the discrepancy between “Tim Smith” and “Tom Smith,” potentially raising suspicions of impropriety.

Additionally, there’s a risk that my credit file could become merged with an individual named “Tim Smith.” While I don’t want to delete this account due to its positive credit history, sending a letter demanding the removal of incorrect names could create complications.

The correct approach to resolve this issue would be to contact the creditor first and inform them of the name inaccuracy. Once the update is made, and the account is correctly tied to “Tom Smith,” I can then send a letter requesting the removal of the incorrect name variations from my credit file.

Choose one form of your name and go with it. For instance:

Thomas A. Smith Jr. – This is the most common structure for financial dealings.

- Arnold Smith Jr. -This is an alternate structure

Thomas Arnold Smith Jr. – This is another alternate structure.

- Maintain uniformity between your legal name and the one utilized across financial records and identification documents.

- If your legal name includes a suffix, ensure its consistent usage, as this will minimize the likelihood of your credit file becoming mixed with others.

- Prior to submitting applications, meticulously review and verify the accuracy of all details provided.

- Avoid the use of nicknames on legal documents to prevent potential discrepancies.

Address Discrepancies and Errors

Address: It is not uncommon for multiple addresses to be listed in your credit reports. These could include your childhood home, a rental property you resided in, or perhaps a friend’s address that you temporarily used.

However, the addresses you want to maintain on your reports are:

- Your current residential address

- Accounts associated with established positive credit history

- Properties you have owned with a mortgage that was paid on time

These types of addresses hold value for credit reports. While having a few addresses listed is normal, an excessive number, such as 10 different addresses, may raise concerns. If a lender is considering extending you a line of credit and notices several different addresses, they may question the reasoning behind such frequent relocations. The concern arises as to whether you will make the monthly payments on time if offered credit, or if you will simply change addresses, leaving the lender in a difficult situation.